Vermont Technical College 2005-2006 Untaxed Income Worksheet B

ADVERTISEMENT

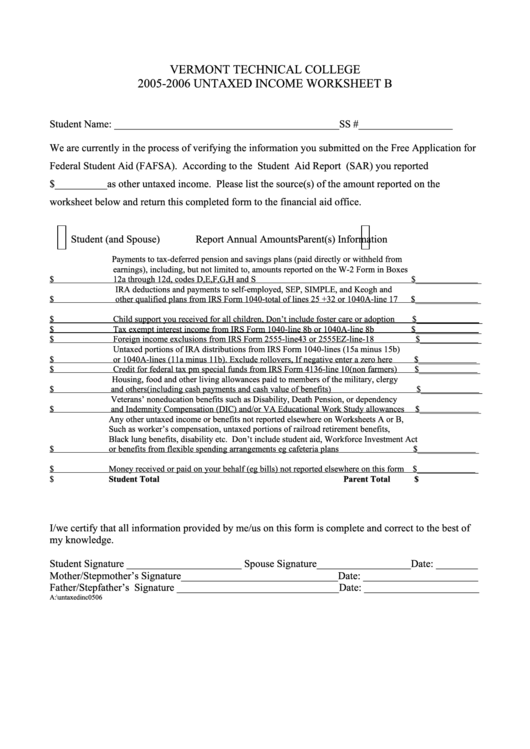

VERMONT TECHNICAL COLLEGE

2005-2006 UNTAXED INCOME WORKSHEET B

Student Name: ___________________________________________SS #__________________

We are currently in the process of verifying the information you submitted on the Free Application for

Federal Student Aid (FAFSA).

According to the Student Aid Report (SAR) you reported

$__________as other untaxed income. Please list the source(s) of the amount reported on the

worksheet below and return this completed form to the financial aid office.

Student (and Spouse)

Report Annual Amounts

Parent(s) Information

Payments to tax-deferred pension and savings plans (paid directly or withheld from

earnings), including, but not limited to, amounts reported on the W-2 Form in Boxes

$

12a through 12d, codes D,E,F,G,H and S

$_______________

IRA deductions and payments to self-employed, SEP, SIMPLE, and Keogh and

$

other qualified plans from IRS Form 1040-total of lines 25 +32 or 1040A-line 17

$_______________

$

Child support you received for all children, Don’t include foster care or adoption

$_______________

$

Tax exempt interest income from IRS Form 1040-line 8b or 1040A-line 8b

$_______________

$

Foreign income exclusions from IRS Form 2555-line43 or 2555EZ-line-18

$______________

Untaxed portions of IRA distributions from IRS Form 1040-lines (15a minus 15b)

$

or 1040A-lines (11a minus 11b). Exclude rollovers, If negative enter a zero here

$______________

$

Credit for federal tax pm special funds from IRS Form 4136-line 10(non farmers)

$______________

Housing, food and other living allowances paid to members of the military, clergy

$

and others(including cash payments and cash value of benefits)

$______________

Veterans’ noneducation benefits such as Disability, Death Pension, or dependency

$

and Indemnity Compensation (DIC) and/or VA Educational Work Study allowances

$______________

Any other untaxed income or benefits not reported elsewhere on Worksheets A or B,

Such as worker’s compensation, untaxed portions of railroad retirement benefits,

Black lung benefits, disability etc. Don’t include student aid, Workforce Investment Act

$

or benefits from flexible spending arrangements eg cafeteria plans

$______________

$

Money received or paid on your behalf (eg bills) not reported elsewhere on this form $______________

$

Student Total

Parent Total

$

I/we certify that all information provided by me/us on this form is complete and correct to the best of

my knowledge.

Student Signature ______________________ Spouse Signature__________________Date: ________

Mother/Stepmother’s Signature______________________________Date: ______________________

Father/Stepfather’s Signature _______________________________Date: ______________________

A:\untaxedinc0506

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3