2006-2007 Verification Worksheet Template

ADVERTISEMENT

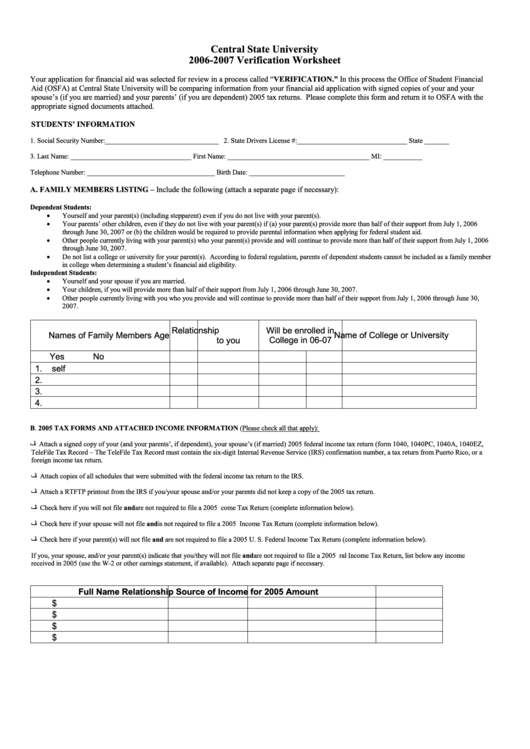

Central State University

2006-2007 Verification Worksheet

Your application for financial aid was selected for review in a process called “VERIFICATION.” In this process the Office of Student Financial

Aid (OSFA) at Central State University will be comparing information from your financial aid application with signed copies of your and your

spouse’s (if you are married) and your parents’ (if you are dependent) 2005 tax returns. Please complete this form and return it to OSFA with the

appropriate signed documents attached.

STUDENTS’ INFORMATION

1. Social Security Number:________________________________ 2. State Drivers License #:_______________________________ State _______

3. Last Name: __________________________________ First Name: ________________________________________ MI: ___________

Telephone Number: ____________________________________ Birth Date: ___________________________

A. FAMILY MEMBERS LISTING – Include the following (attach a separate page if necessary):

Dependent Students:

•

Yourself and your parent(s) (including stepparent) even if you do not live with your parent(s).

•

Your parents’ other children, even if they do not live with your parent(s) if (a) your parent(s) provide more than half of their support from July 1, 2006

through June 30, 2007 or (b) the children would be required to provide parental information when applying for federal student aid.

•

Other people currently living with your parent(s) who your parent(s) provide and will continue to provide more than half of their support from July 1, 2006

through June 30, 2007.

•

Do not list a college or university for your parent(s). According to federal regulation, parents of dependent students cannot be included as a family member

in college when determining a student’s financial aid eligibility.

Independent Students:

•

Yourself and your spouse if you are married.

•

Your children, if you will provide more than half of their support from July 1, 2006 through June 30, 2007.

•

Other people currently living with you who you provide and will continue to provide more than half of their support from July 1, 2006 through June 30,

2007.

Relationship

Will be enrolled in

Names of Family Members

Age

Name of College or University

to you

College in 06-07

Yes

No

1.

self

2.

3.

4.

B. 2005 TAX FORMS AND ATTACHED INCOME INFORMATION (Please check all that apply):

ڤAttach a signed copy of your (and your parents’, if dependent), your spouse’s (if married) 2005 federal income tax return (form 1040, 1040PC, 1040A, 1040EZ,

TeleFile Tax Record – The TeleFile Tax Record must contain the six-digit Internal Revenue Service (IRS) confirmation number, a tax return from Puerto Rico, or a

foreign income tax return.

ڤAttach copies of all schedules that were submitted with the federal income tax return to the IRS.

ڤAttach a RTFTP printout from the IRS if you/your spouse and/or your parents did not keep a copy of the 2005 tax return.

ڤCheck here if you will not file and are not required to file a 2005 U.S. Federal Income Tax Return (complete information below).

ڤCheck here if your spouse will not file and is not required to file a 2005 U.S. Federal Income Tax Return (complete information below).

ڤCheck here if your parent(s) will not file and are not required to file a 2005 U. S. Federal Income Tax Return (complete information below).

If you, your spouse, and/or your parent(s) indicate that you/they will not file and are not required to file a 2005 U.S. Federal Income Tax Return, list below any income

received in 2005 (use the W-2 or other earnings statement, if available). Attach separate page if necessary.

Full Name

Relationship

Source of Income for 2005

Amount

$

$

$

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2