Expense Reimbursement Request

ADVERTISEMENT

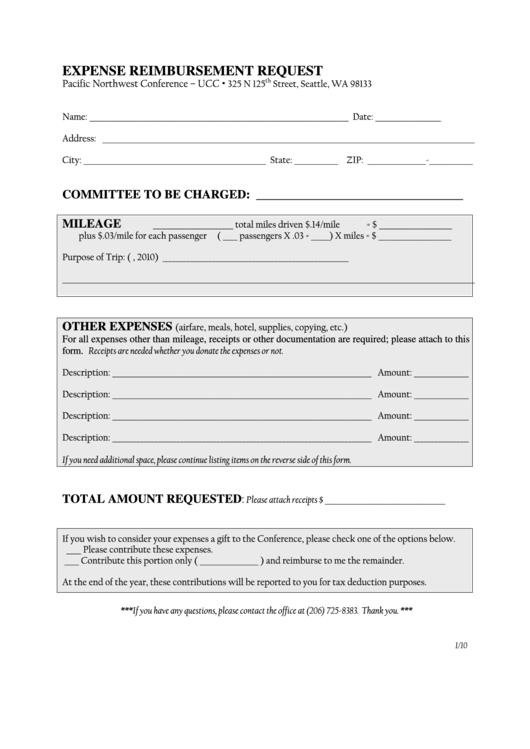

EXPENSE REIMBURSEMENT REQUEST

th

Pacific Northwest Conference – UCC

325 N 125

Street, Seattle, WA 98133

Name: _______________________________________________________________________

Date: __________________

Address: ______________________________________________________________________________________________________

City: __________________________________________________ State: ____________ ZIP: ________________-____________

COMMITTEE TO BE CHARGED: __________________________________

MILEAGE

______________________ total miles driven $.14/mile

= $ ____________________

plus $.03/mile for each passenger

( ____ passengers X .03 = _____) X miles = $ ____________________

Purpose of Trip: (e.g. CLSA meeting on January 31, 2010) ___________________________________________________

_________________________________________________________________________________________________________________

OTHER EXPENSES

(airfare, meals, hotel, supplies, copying, etc.)

For all expenses other than mileage, receipts or other documentation are required; please attach to this

form. Receipts are needed whether you donate the expenses or not.

Description: _______________________________________________________________________ Amount: _______________

Description: _______________________________________________________________________ Amount: _______________

Description: _______________________________________________________________________ Amount: _______________

Description: _______________________________________________________________________ Amount: _______________

If you need additional space, please continue listing items on the reverse side of this form.

Please attach receipts

$ _________________________________

TOTAL AMOUNT REQUESTED:

If you wish to consider your expenses a gift to the Conference, please check one of the options below.

____ Please contribute these expenses.

____ Contribute this portion only ( ________________ ) and reimburse to me the remainder.

At the end of the year, these contributions will be reported to you for tax deduction purposes.

***If you have any questions, please contact the office at (206) 725-8383. Thank you. ***

1/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1