Form 13.1 - Financial Statement (Property And Support Claims) Page 2

ADVERTISEMENT

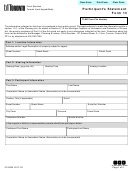

Form 13.1:

Financial Statement (Property and

(page 2)

Court File Number:

Support Claims)

4. Last year, my gross income from all sources was $

(do not subtract any taxes that have been

deducted from this income).

5.

I am attaching all of the following required documents to this financial statement as proof of my income

over the past three years, if they have not already been provided:

a copy of my personal income tax returns for each of the past three taxation years, including any

materials that were filed with the returns.

(Income tax returns must be served but should NOT be filed in the

continuing record, unless they are filed with a motion to refrain a driver’s license suspension.)

a copy of my notices of assessment and any notices of reassessment for each of the past three

taxation years;

where my notices of assessment and reassessment are unavailable for any of the past three taxation

years, an Income and Deductions printout from the Canada Revenue Agency for each of those years,

whether or not I filed an income tax return.

Note: An Income and Deductions printout is available from Canada Revenue Agency. Please call customer

service at 1-800-959-8281.

OR

I am an Indian within the meaning of the Indian Act (Canada) and I have chosen not to file income

tax returns for the past three years. I am attaching the following proof of income for the last three years

(list

documents you have provided):

(In this table you must show all of the income that you are currently receiving.)

Income Source

Amount Received/Month

1.

Employment income (before deductions)

2.

Commissions, tips and bonuses

3.

Self-employment income (Monthly amount before expenses: $

)

4.

Employment Insurance benefits

5.

Workers’ compensation benefits

6.

Social assistance income (including ODSP payments)

7.

Interest and investment income

8.

Pension income (including CPP and OAS)

9.

Spousal support received from a former spouse/partner

10.

Child Tax Benefits or Tax Rebates (e.g. GST)

11.

Other sources of income (e.g. RRSP withdrawals, capital gains)

(*attach Schedule A

and divide annual amount by 12)

$0.00

12.

Total monthly income from all sources:

13.

Total monthly income X 12 = Total annual income:

$0.00

14.

Other Benefits

Provide details of any non-cash benefits that your employer provides to you or are paid for by your business such as medical insurance

coverage, the use of a company car, or room and board.

Item

Details

Yearly Market Value

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12