Form 13.1 - Financial Statement (Property And Support Claims) Page 7

ADVERTISEMENT

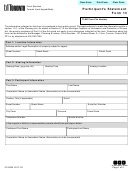

Form 13.1:

Financial Statement (Property and

(page 7)

Court File Number:

Support Claims)

Debts and other liabilities

(Specify.)

$0.00

$0.00

$0.00

TOTALS

$0.00

24. NET VALUE OF PROPERTY OWNED ON DATE OF MARRIAGE

(From the total of the “Assets” column, subtract the total of the “Liabilities” column.)

$0.00

25. VALUE OF ALL DEDUCTIONS

(Add items [23] and [24].)

PART 7: EXCLUDED PROPERTY

Show by category the value of property owned on the valuation date that is excluded from the definition of “net family property” (such

as gifts or inheritances received after marriage).

Value on

Category

Details

valuation date

Gift or inheritance from third person

Income from property expressly excluded by

donor/testator

Damages and settlements for personal injuries, etc.

Life insurance proceeds

Traced property

Excluded property by spousal agreement

Other Excluded Property

$0.00

26. TOTAL VALUE OF EXCLUDED PROPERTY

PART 8: DISPOSED-OF PROPERTY

Show by category the value of all property that you disposed of during the two years immediately preceding the making of this

statement, or during the marriage, whichever period is shorter.

Category

Details

Value

$0.00

27. TOTAL VALUE OF DISPOSED-OF PROPERTY

PART 9: CALCULATION OF NET FAMILY PROPERTY

Deductions

BALANCE

$0.00

Value of all property owned on valuation date

(from item [22] above)

$0.00

$0.00

Subtract value of all deductions

(from item [25] above)

$0.00

$0.00

Subtract total value of all excluded property

(from item [26] above)

$0.00

28. NET FAMILY PROPERTY

NOTE: This financial statement must be updated no more than 30 days before any court event by either completing and filing:

a new financial statement with updated information, or

an affidavit in Form 14A setting out the details of any minor changes or confirming that the information contained in this statement

remains correct.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12