Sample Hardship Letter Template

ADVERTISEMENT

100

FORECLOSURE PREVENTION COUNSELING

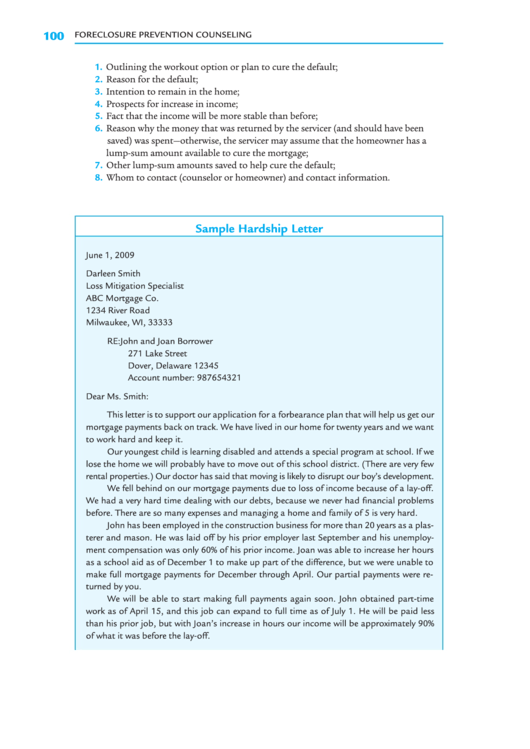

Outlining the workout option or plan to cure the default;

1.

2.

Reason for the default;

Intention to remain in the home;

3.

4.

Prospects for increase in income;

5.

Fact that the income will be more stable than before;

6.

Reason why the money that was returned by the servicer (and should have been

saved) was spent—otherwise, the servicer may assume that the homeowner has a

lump-sum amount available to cure the mortgage;

7.

Other lump-sum amounts saved to help cure the default;

8.

Whom to contact (counselor or homeowner) and contact information.

Sample Hardship Letter

June 1, 2009

Darleen Smith

Loss Mitigation Specialist

ABC Mortgage Co.

1234 River Road

Milwaukee, WI, 33333

RE: John and Joan Borrower

271 Lake Street

Dover, Delaware 12345

Account number: 987654321

Dear Ms. Smith:

This letter is to support our application for a forbearance plan that will help us get our

mortgage payments back on track. We have lived in our home for twenty years and we want

to work hard and keep it.

Our youngest child is learning disabled and attends a special program at school. If we

lose the home we will probably have to move out of this school district. (There are very few

rental properties.) Our doctor has said that moving is likely to disrupt our boy’s development.

We fell behind on our mortgage payments due to loss of income because of a lay-off.

We had a very hard time dealing with our debts, because we never had financial problems

before. There are so many expenses and managing a home and family of 5 is very hard.

John has been employed in the construction business for more than 20 years as a plas-

terer and mason. He was laid off by his prior employer last September and his unemploy-

ment compensation was only 60% of his prior income. Joan was able to increase her hours

as a school aid as of December 1 to make up part of the difference, but we were unable to

make full mortgage payments for December through April. Our partial payments were re-

turned by you.

We will be able to start making full payments again soon. John obtained part-time

work as of April 15, and this job can expand to full time as of July 1. He will be paid less

than his prior job, but with Joan’s increase in hours our income will be approximately 90%

of what it was before the lay-off.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Letters

1

1 2

2