Clear form

TC-805, Page 3

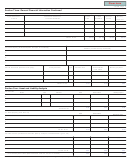

Section Five: Monthly Income and Expense Analysis

INCOME

NECESSARY LIVING EXPENSES

Source

Gross

Net

Type of expense

Amount

40. Rent (do not show mortgage listed

30. Taxpayer’s wages/salaries

$

$

(attach 2 most recent check stubs)

in item 27)

31. Spouse’s wages/salaries

$

41. Groceries (no. of people ____)

(attach 2 most recent check stubs)

42. Payment Totals

32. Interest/Dividends

(from line 29) "Official Use Only"

43. Utilities (average of last 12 months)

33. Net business income

(from form_____)

Gas $______

Water $_______

0.00

34. Rental income

Telephone $_____

Electric $_____

44. Transportation (bus, fares, gasoline

35. Pension (taxpayer)

maintenance, etc.)

45. Insurance

36. Pension (spouse)

Home $____

Health $_____

0.00

37. Child Support

Car $______

46. Medical

38. Alimony

Doctor $______

Dentist $_____

0.00

39. Other

Hospitals $_____

Other $______

47. Payments made to IRS for

delinquent taxes

48. Child support

49. Estimated tax prepayments

0.00

IRS ______

State ______

50. Other expenses (specify)

0.00

$

0.00

$

$

0.00

TOTAL

TOTAL

Net difference

$

0.00

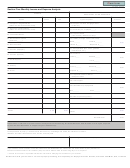

Information contained in this document is subject to verification by the Utah State Tax Commission. You may be required

to provide documentation in support of your statement(s).

Under penalties of perjury, I declare that to the best of my knowledge and belief, this statement of assets,

liabilities, and other information is true, correct, and complete.

Your signature: (required)

Date

Spouses signature (required if jointly liable)

Date

If you need an accommodation under the American’s with Disabilities Act, contact the Tax Commission at (801) 297-3811 or

Telecommunications Device for the Deaf (801) 297-3819. Please allow three working days for a response.

** Failure to furnish ALL requested information will result in delaying the resolution of your account.

DO NOT mail with your tax return. To insure proper processing, mail separately to: Taxpayer Services Division, 210 North 1950 West, SLC, UT 84134

1

1 2

2 3

3