Sample Lesson Know Your Take-Home Pay

ADVERTISEMENT

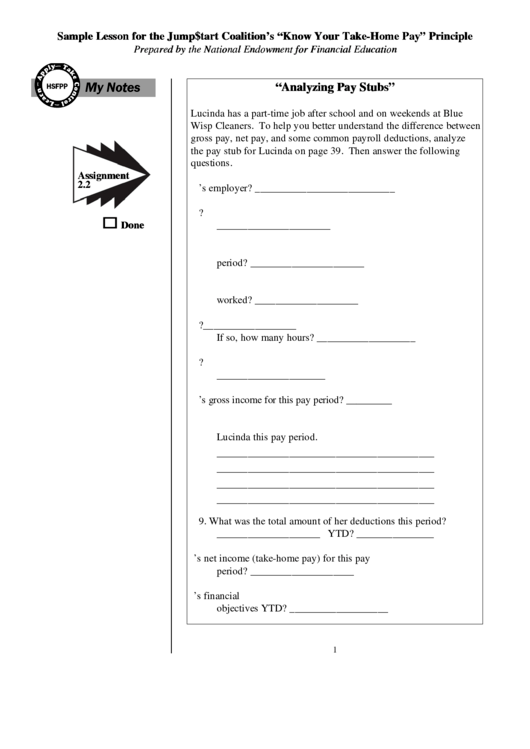

Sample Lesson for the Jump$tart Coalition’s “Know Your Take-Home Pay” Principle

Prepared by the National Endowment for Financial Education

My Notes

HSFPP

“Analyzing Pay Stubs”

Lucinda has a part-time job after school and on weekends at Blue

Wisp Cleaners. To help you better understand the difference between

gross pay, net pay, and some common payroll deductions, analyze

the pay stub for Lucinda on page 39. Then answer the following

questions.

Assignment

2.2

1. Who is Lucinda’s employer? ___________________________

2. What is the length of the pay period Lucinda just worked?

Done

______________________

3. How many total hours did Lucinda work during this pay

period? ______________________

4. What amount per hour does Lucinda get paid for regular hours

worked? ____________________

5. Did she work any overtime this period? __________________

If so, how many hours? ___________________

6. What amount per hour does Lucinda get paid for overtime?

_____________________

7. What is Lucinda’s gross income for this pay period? _________

8. List the type and amount of each payroll deduction for

Lucinda this pay period.

__________________________________________

__________________________________________

__________________________________________

__________________________________________

9. What was the total amount of her deductions this period?

____________________ YTD? _______________

10. What is Lucinda’s net income (take-home pay) for this pay

period? ____________________

11. What amount has been available for Lucinda’s financial

objectives YTD? ___________________

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Education

1

1 2

2