Limited Liability Company Return Of Income Tc65 Page 10

ADVERTISEMENT

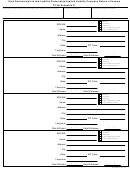

Utah Partnership/Limited Liability Partnership/Limited Liability Company Return of Income

TC-65 Schedule N

Partnership/Limited Liability Partnership/Limited Liability Company Name

Taxable Year Ending

Employer Identification Number

Nonresident Tax Remittance Information

Instructions: Partnerships/limited liability partnerships/limited liability companies that are making income tax payments on

behalf of nonresident partners/members should complete this form. These are partnerships/limited liability partnerships/

limited liability companies that file a composite return.

Composite partnership/limited liability partnership/limited liability company filers should list below all nonresident partners/

members for whom Utah individual income tax is being paid. The social security number (SSN) or employer identification

number (EIN), the percentage of partnership/limited liability partnership/limited liability company income, and the Utah

income attributable to each nonresident partner/member must be indicated.

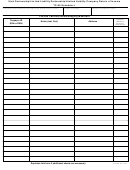

Percent Of

Attributable

Nonresident Partner/Member Name

SSN or EIN

Income

Utah Income

TOTAL (also enter on TC-65, line 8)

Duplicate this form if additional sheets are necessary

65N.FRM Rev. 12/01

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10