Buyer Qualification Worksheet Old Republic National Title Insurance

ADVERTISEMENT

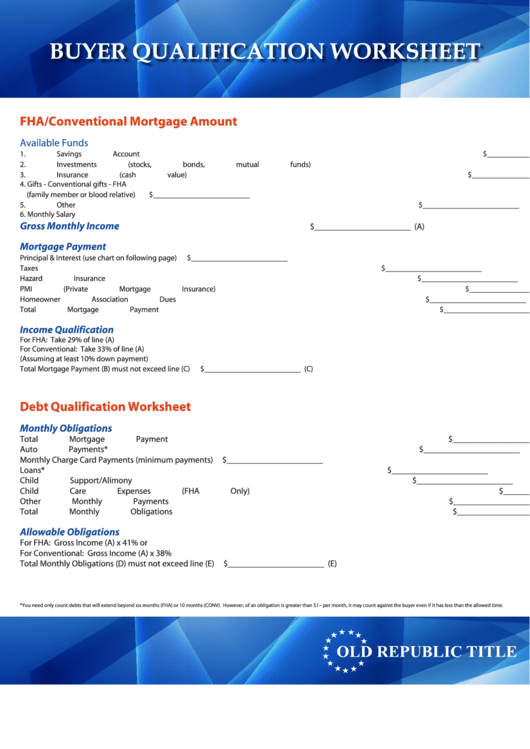

BUYER QUALIFICATION WORKSHEET

FHA/Conventional Mortgage Amount

Available Funds

______________________

1. Savings Account

$

______________________

2. Investments (stocks, bonds, mutual funds)

$

______________________

3. Insurance (cash value)

$

4. Gifts - Conventional gifts - FHA

______________________

(family member or blood relative)

$

______________________

5. Other

$

6. Monthly Salary

Gross Monthly Income

$______________________ (A)

Mortgage Payment

______________________

Principal & Interest (use chart on following page)

$

______________________

Taxes

$

______________________

Hazard Insurance

$

______________________

PMI (Private Mortgage Insurance)

$

______________________

Homeowner Association Dues

$

______________________

Total Mortgage Payment

$

(B)

Income Qualification

For FHA: Take 29% of line (A)

For Conventional: Take 33% of line (A)

(Assuming at least 10% down payment)

______________________

Total Mortgage Payment (B) must not exceed line (C)

$

(C)

Debt Qualification Worksheet

Monthly Obligations

Total Mortgage Payment

$______________________

Auto Payments*

$______________________

Monthly Charge Card Payments (minimum payments)

$______________________

Loans*

$______________________

Child Support/Alimony

$______________________

Child Care Expenses (FHA Only)

$______________________

Other Monthly Payments

$______________________

Total Monthly Obligations

$______________________ (D)

Allowable Obligations

For FHA: Gross Income (A) x 41% or

For Conventional: Gross Income (A) x 38%

Total Monthly Obligations (D) must not exceed line (E)

$______________________ (E)

*You need only count debts that will extend beyond six months (FHA) or 10 months (CONV). However, of an obligation is greater than $1-- per month, it may count against the buyer even if it has less than the allowed time.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2