Notice Of Garnishment Page 3

Download a blank fillable Notice Of Garnishment in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Notice Of Garnishment with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

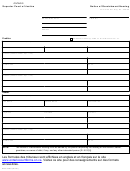

FORM 20E

PAGE 2

Claim No.

TO THE GARNISHEE:

The creditor has obtained a court order against the debtor. The creditor claims that you owe or will owe the debtor a debt in

the form of wages, salary, pension payments, rent, annuity or other debt that you pay out in a lump-sum, periodically or by

instalments. (A debt to the debtor includes both a debt payable to the debtor alone and a joint debt payable to the debtor and one

or more co-owners.)

YOU ARE REQUIRED TO PAY to the clerk of the

Small Claims Court

(Garnishment issuing court)

(a) all debts now payable by you to the debtor, within 10 days after this notice is served on you; and

(b) all debts that become payable by you to the debtor after this notice is served on you and within 6 years after this notice is

issued, within 10 days after they become payable.

The total amount of all your payments to the clerk is not to exceed $

.

(Amount unsatisfied)

THIS NOTICE IS LEGALLY BINDING ON YOU until it expires or is changed, renewed, terminated or satisfied. If you do not pay

the total amount or such lesser amount as you are liable to pay, you must serve a Garnishee’s Statement (Form 20F) on the

creditor and debtor, and file it with the clerk within 10 days after this notice is served on you.

EACH PAYMENT, payable to the Minister of Finance, MUST BE SENT with a copy of the attached garnishee’s payment

notice to the clerk at the above court address.

If your debt is jointly owed to the debtor and to one or more co-owners, you must pay the debtor’s appropriate share of the

amount now payable, or which becomes payable, or such a percentage as the court may order.

The amounts paid into court shall not exceed the portion of the debtor’s wages that are subject to seizure or

garnishment under Section 7 of the Wages Act (information available at:

and

). The portion of wages that can be garnished may be increased or decreased only by order of the court. If

such a court order is attached to this notice or is served on you, you must follow the direction in that court order.

, 20

(Signature of clerk)

CAUTION TO

IF YOU FAIL TO PAY to the clerk the amount set out in this notice and do not file a Garnishee’s Statement (Form

GARNISHEE:

20F) disputing garnishment, JUDGMENT MAY BE OBTAINED AGAINST YOU BY THE CREDITOR for payment

of the amount set out above, plus costs. If you make a payment to anyone other than the clerk of the court, you

may be liable to pay again [R. 20.08(17) and (18)].

NOTE:

Any party or interested person may complete and serve a Notice of Garnishment Hearing (Form 20Q) to determine any

matter related to this notice. To obtain forms and self-help materials, attend the nearest Small Claims Court or access

the following website:

Continued on next page

RSCC-20E-E (2014/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4