Print form

Clear form

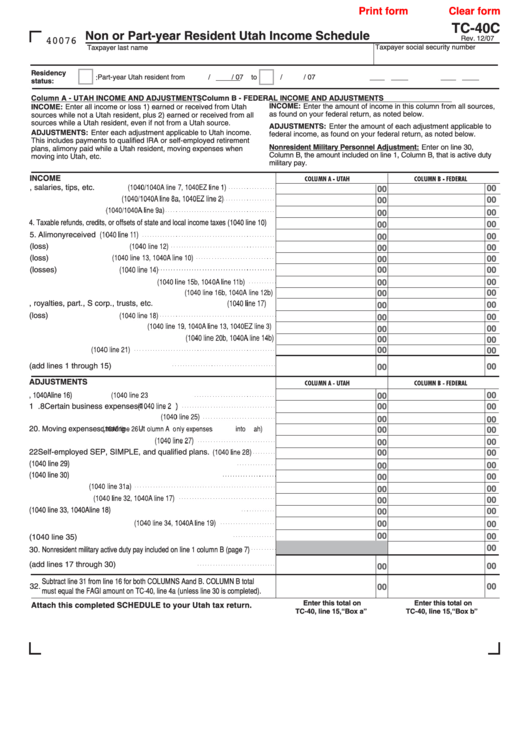

TC-40C

Non or Part-year Resident Utah Income Schedule

Rev. 12/07

40076

Taxpayer last name

Taxpayer social security number

Residency

Part-year Utah resident from

/

/ 07

to

/

/ 07

Nonresident. Home state abbreviation:

status:

Column A - UTAH INCOME AND ADJUSTMENTS

Column B - FEDERAL INCOME AND ADJUSTMENTS

INCOME:

Enter the amount of income in this column from all sources,

INCOME:

Enter all income or loss 1) earned or received from Utah

as found on your federal return, as noted below.

sources while not a Utah resident, plus 2) earned or received from all

sources while a Utah resident, even if not from a Utah source.

ADJUSTMENTS:

Enter the amount of each adjustment applicable to

ADJUSTMENTS:

Enter each adjustment applicable to Utah income.

federal income, as found on your federal return, as noted below.

This includes payments to qualified IRA or self-employed retirement

Nonresident Military Personnel Adjustment:

Enter on line 30,

plans, alimony paid while a Utah resident, moving expenses when

Column B, the amount included on line 1, Column B, that is active duty

moving into Utah, etc.

military pay.

INCOME

1. Wages, salaries, tips, etc.

00

00

2. Taxable interest income

00

00

3. Ordinary dividends

00

00

4. Taxable refunds, credits, or offsets of state and local income taxes (1040 line 10)

00

00

5. Alimony received

00

00

6. Business income or (loss)

00

00

7. Capital gain or (loss)

00

00

00

00

8. Other gains or (losses)

9. IRA distributions - taxable amount

00

00

00

10. Pensions and annuities - taxable amount

00

11. Rental real estate, royalties, part., S corp., trusts, etc.

00

00

12. Farm income or (loss)

00

00

13. Unemployment compensation

00

00

14. Social Security benefits - taxable amount

00

00

15. Other income

00

00

16. Total income (add lines 1 through 15)

00

00

ADJUSTMENTS

00

17. Educator expenses

, 1040A line 16)

00

1 . 8 Certain business expenses

4

00

00

19. Health savings account deduction

00

00

20. Moving expenses

c

,

moving

Ut

00

00

21. One-half of self-employment tax

00

00

22 Self-employed SEP, SIMPLE, and qualified plans

.

00

00

23. Self-employed health insurance deduction (1040 line 29)

00

00

24. Penalty on early withdrawal of savings (1040 line 30)

00

00

25. Alimony paid

00

00

26. IRA deduction

00

00

27. Student loan interest deduction (1040 line 33, 1040A line 18)

00

00

28. Tuition and fees deduction

00

00

00

00

29. Domestic production activities deduction (1040 line 35)

00

30. Nonresident military active duty pay included on line 1 column B (page 7)

31. Total adjustments (add lines 17 through 30)

00

00

Subtract line 31 from line 16 for both COLUMNS A and B. COLUMN B total

32.

00

00

must equal the FAGI amount on TC-40, line 4a (unless line 30 is completed).

Enter this total on

Enter this total on

Attach this completed SCHEDULE to your Utah tax return.

TC-40, line 15, “Box a”

TC-40, line 15, “Box b”

1

1