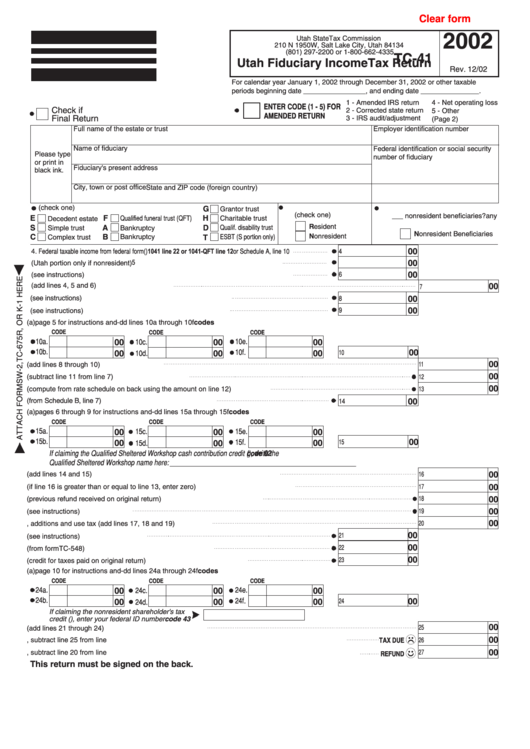

Clear form

2002

Utah State Tax Commission

210 N 1950 W, Salt Lake City, Utah 84134

(801) 297-2200 or 1-800-662-4335

TC-41

Utah Fiduciary Income Tax Return

Rev. 12/02

For calendar year January 1, 2002 through December 31, 2002 or other taxable

periods beginning date ________________, and ending date _______________.

1 - Amended IRS return

4 - Net operating loss

ENTER CODE (1 - 5) FOR

Check if

2 - Corrected state return

5 - Other

AMENDED RETURN

Final Return

3 - IRS audit/adjustment

(Page 2)

Full name of the estate or trust

Employer identification number

Name of fiduciary

Federal identification or social security

Please type

number of fiduciary

or print in

Fiduciary's present address

black ink.

City, town or post office

State and ZIP code (foreign country)

2. Status of estate or trust

1. Type of return (check one)

3. Check if this estate or trust has

G

Grantor trust

(check one)

any

nonresident beneficiaries?

E

F

Qualified funeral trust (QFT)

H

Charitable trust

Decedent estate

Resident

S

A

Bankruptcy estate. Ch 7

D

Qualif. disability trust

Simple trust

Nonresident Beneficiaries

B

Nonresident

C

Bankruptcy estate. Ch 11

T

ESBT (S portion only)

Complex trust

1041 line 22 or 1041-QFT line 12 or Schedule A, line 10

00

4

4. Federal taxable income from federal form

(

)

5

00

5. State income taxes deducted on federal return (Utah portion only if nonresident)

6

00

6. Interest on U.S. government obligations allocated to beneficiaries (see instructions)

7. Total adjusted income (add lines 4, 5 and 6)

00

7

8. One-half of federal tax liability on federal return (see instructions)

00

8

00

9

9. State tax add-back allocated to beneficiaries (see instructions)

10. Other deductions (

page 5 for instructions and

codes

- dd lines 10a through 10f

a

)

CODE

CODE

CODE

10a.

10e.

00

10c.

00

00

10b.

00

10f.

10

00

00

00

10d.

00

11

11. Total deductions (add lines 8 through 10)

00

12. Utah taxable income (subtract line 11 from line 7)

12

00

13. Utah tax (compute from rate schedule on back using the amount on line 12)

13

14. Credit for tax paid to another state (from Schedule B, line 7)

00

14

15. Nonrefundable credits (

pages 6 through 9 for instructions and

codes

- dd lines 15a through 15f

a

)

CODE

CODE

CODE

15a.

15e.

00

15c.

00

00

15b.

00

15f.

15

00

00

15d.

00

If claiming the Qualified Sheltered Workshop cash contribution credit (

code 02

), write the

Qualified Sheltered Workshop name here:

___________________________________________________

00

16. Total tax paid to another state and nonrefundable credits (add lines 14 and 15)

16

17

00

17. Subtract line 16 from line 13 (if line 16 is greater than or equal to line 13, enter zero)

18

18. AMENDED RETURNS ONLY (previous refund received on original return)

00

00

19

19. Utah use tax (see instructions)

00

20

20. Total tax, additions and use tax (add lines 17, 18 and 19)

00

21

21. Utah tax withheld (see instructions)

00

22

22. Credit for Utah income taxes prepaid (from form TC-548)

00

23

23. AMENDED RETURNS ONLY (credit for taxes paid on original return)

24. Refundable credits (

page 10 for instructions and

codes

- dd lines 24a through 24f

a

)

CODE

CODE

CODE

24a.

24e.

00

24c.

00

00

24b.

24f.

00

00

24

00

24d.

00

If claiming the nonresident shareholder's tax

credit (

code 43

), enter your federal ID number

00

25

25. Total withholdings and credits (add lines 21 through 24)

00

26. TAX DUE - if line 20 is greater than line 25, subtract line 25 from line 20. This is the amount you owe.

TAX DUE

26

00

27. REFUND - if line 25 is greater than line 20, subtract line 20 from line 25. This is the amount you overpaid.

27

REFUND

This return must be signed on the back.

1

1 2

2