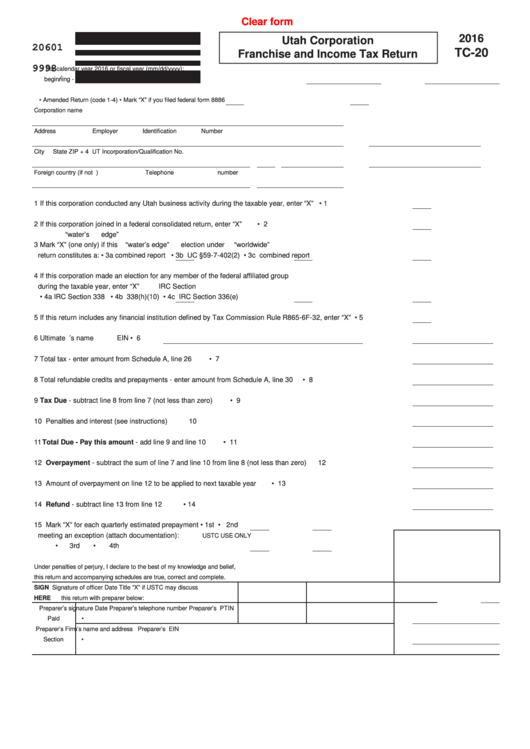

Clear form

2016

Utah Corporation

20601

TC-20

Franchise and Income Tax Return

9998

For calendar year 2016 or fiscal year (mm/dd/yyyy):

/

/

/

/

beginning -

and ending -

USTC ORIGINAL FORM

•

Amended Return (code 1-4)

•

Mark “X” if you filed federal form 8886

Corporation name

Address

Employer Identification Number

City

State

ZIP + 4

UT Incorporation/Qualification No.

Foreign country (if not U.S.)

Telephone number

1

If this corporation conducted any Utah business activity during the taxable year, enter “X”

• 1

2

If this corporation joined in a federal consolidated return, enter “X”

• 2

“water’s edge”

3

Mark “X” (one only) if this

“water’s edge”

election under

“worldwide”

return constitutes a:

• 3a

combined report

• 3b

UC §59-7-402(2)

• 3c

combined report

4

If this corporation made an election for any member of the federal affiliated group

during the taxable year, enter “X”

IRC Section

• 4a

IRC Section 338

• 4b

338(h)(10)

• 4c

IRC Section 336(e)

5

If this return includes any financial institution defined by Tax Commission Rule R865-6F-32, enter “X”

• 5

6

Ultimate U.S. parent’s name

EIN

• 6

7

Total tax - enter amount from Schedule A, line 26

• 7

8

Total refundable credits and prepayments - enter amount from Schedule A, line 30

• 8

9

Tax Due - subtract line 8 from line 7 (not less than zero)

• 9

10 Penalties and interest (see instructions)

10

11 Total Due - Pay this amount - add line 9 and line 10

• 11

12 Overpayment - subtract the sum of line 7 and line 10 from line 8 (not less than zero)

12

13 Amount of overpayment on line 12 to be applied to next taxable year

• 13

14 Refund - subtract line 13 from line 12

• 14

15 Mark “X” for each quarterly estimated prepayment

•

1st

•

2nd

meeting an exception (attach documentation):

USTC USE ONLY

•

3rd

•

4th

Under penalties of perjury, I declare to the best of my knowledge and belief,

this return and accompanying schedules are true, correct and complete.

SIGN

Signature of officer

Date

Title

“X” if USTC may discuss

HERE

this return with preparer below:

Preparer’s signature

Date

Preparer’s telephone number

Preparer’s PTIN

Paid

•

Preparer’s

Firm’s name and address

Preparer’s EIN

Section

•

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13