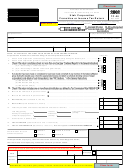

Schedule A - Utah Net Taxable Income and Tax Calculation

TC-20, Sch. A

Pg. 1

20603

2016

EIN

USTC ORIGINAL FORM

1

Unadjusted income (loss) before NOL and special deductions from federal form 1120, line 28

• 1

2

Additions to unadjusted income from Schedule B, line 15

• 2

3

Add line 1 and line 2

3

4

Subtractions from unadjusted income from Schedule C, line 16

• 4

5

Adjusted income (loss) - subtract line 4 from line 3

• 5

6

Utah net nonbusiness income from Schedule H, line 14

• 6

7

Non-Utah net nonbusiness income from Schedule H, line 28

• 7

8

Total nonbusiness income net of expenses - add line 6 and line 7

8

9

Apportionable income (loss) before contributions deduction - subtract line 8 from line 5

• 9

10 Utah contributions deduction from Schedule D, line 6

• 10

11 Apportionable income (loss) - subtract line 10 from line 9

11

12 Apportionment fraction - enter 1.000000, or Schedule J, line 9, 13 or 14, if applicable

12

13 Apportioned income (loss) - multiply line 11 by line 12

• 13

14 Utah net nonbusiness income (from line 6 above)

14

15 Utah income (loss) before Utah net loss deduction - add line 13 and line 14

• 15

If line 15 is a loss AND you made an election to forego the federal net

operating loss carryback, do you also elect to forego the Utah net loss

•

Yes

•

No

carryback? (See instructions.)

16 Utah net loss carried forward from prior years (attach documentation)

• 16

17 Net Utah taxable income (loss) - subtract line 16 from line 15

• 17

18 Calculation of tax (see instructions):

a

Multiply line 17 by 5% (.05) (not less than zero)

18a

b

Minimum tax - enter $100 or amount from Schedule M, line b

• 18b

Tax amount - enter the greater of line 18a or line 18b

• 18

19 Interest on installment sales

• 19

20 Recapture of low-income housing credit

• 20

21 Total tax - add lines 18 through 20

• 21

Carry to Schedule A, page 2, line 22

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13