Form Tc-20 - Utah Corporation Franchise Or Income Tax Return - 2000 Page 6

ADVERTISEMENT

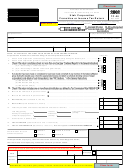

TC- 20 J

Schedule J - Apportionment Schedule

Rev. 12/00

Corporation Name

Taxable Year Ending

Employer Identification Number

Describe briefly the nature and location(s) of your Utah business activities:

Inside Utah

Inside and Outside Utah

1.

Tangible Property

Column B

Column A

1(a)

00

(a)

Land

00

00

00

(b)

1(b)

Depreciable assets

(c)

00

00

Inventory and supplies

1(c)

Rented property

(d)

00

00

1(d)

(e)

Other tangible property

00

1(e)

00

2.

Total Tangible Property (total 1(a) through 1(e))

00

00

2

(a)

Fraction (column (A), line 2 divided by column (B), line 2)

2(a)

3.

Wages, salaries, commissions, and

3

00

00

other includable compensation

(a)

Fraction (column (A), line 3 divided by column (B), line 3)

3(a)

4.

Gross Receipts from Business

4(a)

(a)

Sales (gross receipts less returns and allowances)

00

(b)

Sales delivered or shipped to Utah purchasers:

4(b1)

00

(1) Shipped from outside Utah

(2) Shipped from within Utah

4(b2)

00

(c)

Sales shipped from Utah to:

4(c1)

00

(1) United States Government

(2)

Purchasers in a state(s) where the taxpayer has no

4(c2)

nexus (The corporation is not taxable in the state of

00

purchaser)

(d)

Rent and royalty income

4(d)

00

00

(e)

Service income (attach schedule)

4(e)

00

00

5.

Total Sales and Services (total 4(a) through 4(e))

00

5

00

(a)

5(a)

Fraction (column (A), line 5 divided by column (B), line 5)

6.

Total of lines 2a, 3a, and 5a

6

7.

Calculate the

Apportionment Fraction

to

six decimals:

(line 6 divided by 3 or the number

7

of factors present) (Also enter on

Schedule A, line 9)

NOTE: This schedule is to be used only if income is taxable in another state

and should be apportioned to Utah.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7