Form Tc-20 - Utah Corporation Franchise Or Income Tax Return - 2000 Page 7

ADVERTISEMENT

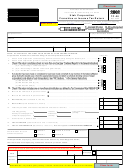

TC-20 M

Schedule M - Corporations Included in Combined Filings

Rev. 12/00

Employer Identification Number

Taxable Year Ending

Corporation Name

Instructions

1.

Only corporations incorporated, qualified, or doing business in Utah should be listed on this form.

2.

Federal schedules are not acceptable as a substitute since they may include corporations that are excluded from reporting in Utah.

3.

Corporations required to file in Utah that are not listed on this form will not be considered to have met the Utah filing requirement.

4.

List the filing period if it is different from the parent corporation's filing period.

5.

At least the minimum tax of $100 per corporation listed on this schedule must be entered on Schedule A, line 15a.

Total number of corporations in Utah multiplied by the minimum tax of $100 =

$

List

only

corporations included in this return that are doing business, incorporated, or qualified in Utah

(attach additional sheets if necessary)

Employer Identification

Utah Incorporation/

Common Parent Corporation Name

Number

Qualification Number

Filing period

Employer Identification

Utah Incorporation/

(if different from parent)

Merge date

Number

Qualification Number

Affiliate/Subsidiary Corporation name

Begin date

End date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7