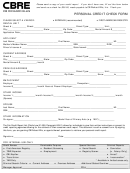

Personal Credit Application Form Page 2

ADVERTISEMENT

Personal Credit—Council Bluffs Savings Bank

CREDIT CARD DISCLOSURE

Platinum Card/Platinum Rewards Card

A 0% introductory APR for purchases during the first six

Other Fees: Returned Payment Fee: $35.00 per

credit is granted, is furnished a copy of the agreement,

Annual

billing cycles*. After that, a variable APR of WSJ Prime Rate**

Periodic Statement copy; $5.00 per Transaction Copy.

statement or decree or has actual knowledge of the

Percentage

Rate (APR)

(7.24%)

(9.24%)

This information was accurate when printed in 04/08

adverse provision when the obligation to the creditor is

Prime

for purchases

,

,

and may have changed thereafter. Call 1-866-274-

incurred. The creditor may give notice of the opening

+1.99%

+3.99%

2328 to find out what may have changed.

of any credit account to the applicant’s spouse. IF

(12.24%)

(14.24%)

Prime

Prime

Notice for California Residents: A married applicant

YOU ARE A MARRIED WISCONSIN RESIDENT, CREDIT

,

,

+6.99%

+8.99%

or

may apply for a separate account. As required by law,

EXTENDED UNDER THIS ACCOUNT WILL BE INCURRED

(18.24%)

Prime

you are hereby notified that a negative credit report

IN THE INTEREST OF YOUR MARRIAGE OR FAMILY.

+12.99%

reflecting on your credit record may be submitted to a

*Introductory Rate: The introductory APR for

credit reporting agency if you fail to fulfill the terms of

Purchases and Balance Transfers will remain in effect

depending on our review of your application and credit history.

your credit obligations. If we take any adverse action

through the closing date of the sixth billing cycle after

(as of 04/08).

as defined by Section 1785.3 of the California Civil

your Account is opened, so long as the Minimum

Code and the adverse action is based, in whole or

Amount Due on Account Statements is paid by each

Cash Rewards Card

in part, on any information contained in a consumer

Payment Due Date during the promotional period. If

credit report, you have the right to obtain within 60

not, the introductory APR will adjust in the billing cycle

A 0% introductory APR for purchases during the first six

Annual

days a free copy of your consumer credit report from

following any late payment to the variable APR for

billing cycles*. After that, a variable APR of WSJ Prime Rate**

the consumer reporting agency who furnished us your

Purchases and Balance Transfers then in effect, or the

Percentage

Rate (APR)

consumer credit report and from any other consumer

Delinquency APR, as applicable.

(14.24%)

for purchases

credit reporting agency which compiles and maintains

**The WSJ Prime Rate means the highest prime

+8.99%

(as of 04/08).

files on consumers on a nationwide basis. You have the

rate published in The Wall Street Journal on the

right as described by Section 1785.16 of the California

day the rate is determined (or the previous day on

which The Wall Street Journal was published if

Civil Code to dispute the accuracy or completeness of

All Cards

any information in a consumer credit report furnished

the paper is not published on that day). The date

by the consumer credit reporting agency.

the rate is determined is the third Friday of each

Other APRs

Introductory Balance Transfer APR: 0% for first six billing

Notice for New York Residents: A consumer report

month. Any increase or decrease in the WSJ Prime

cycles*; after that, variable APR for Purchases;

may be requested in connection with this application.

Rate will result in an increase or decrease in your

Cash Advance APR; WSJ Prime Rate** + 10.99%;

Upon your request, you will be informed whether or not

monthly periodic rate and corresponding APR.

19.99% minimum, 24.99% maximum (19.99% as of 04/08).

These changes will be applied, as applicable, to

Delinquency APR: 23.99%. See explanation below.***

a consumer report was requested, and if such report

your existing account balance and to subsequent

was requested, informed of the name and address

Your annual percentage rate may vary monthly. The APR for

Variable Rate

of the consumer reporting agency that furnished

transactions effective as of the first day of the

Information

Purchases and Cash Advances is based on the WSJ Prime

the report. Subsequent consumer reports may be

billing cycle immediately following the month in

Rate plus a margin. The rate is calculated monthly by adding

requested or utilized in connection with an update,

which we calculate the rate.

the margin applicable to the account to the WSJ Prime Rate.**

renewal or extension of the credit for which application

***Delinquency APR: If you fail to pay the Minimum

was made. New York residents may contact the New

Amount Due on your account by the Payment Due Date,

None

Annual Fee

York State Banking department to obtain a comparative

we reserve the right to increase the Annual Percentage

listing of credit card rates, fees and grace periods. New

Rate to 23.99% (corresponding Daily Periodic Rate

Grace Period

A minimum of 25 days from the Billing Date (provided

York State Banking Department 1-800-518-8866.

.06573%) and we will apply the Delinquency APR to the

for Repayment

that the previous account balance is paid in full by its

Notice for Ohio Residents: The Ohio laws against

existing balance of your account and to all subsequent

of the Balance

Payment Due Date)

discrimination require that all creditors make credit

transactions posted to your account as of the first day

of Purchases

equally available to all credit worthy customers and

of the second consecutive Minimum Amount Due on

Method of

Average daily balance (including current transactions)

that credit reporting agencies maintain separate credit

your account occurred. Once you become subject to

Computing

histories on each individual upon request. The Ohio

the Delinquency APR, we may change your APR back

the Balance

Civil Rights Commission administers compliance with

to the respective APR for your account but only if you

for Purchases

this law.

bring your account current and then pay at least the

Notice for Rhode Island Residents: A credit report

Minimum Amount Due by the Payment Due Date for

Minimum

$1.00 (if the total of a Finance Charge being added to

may be requested in connection with this application.

six (6) consecutive billing cycles.

Finance

your account is less than $1.00 in any billing cycle)

Notice for Vermont Residents: A consumer credit

Arbitration: The Card Agreement includes an

Charge

report may be requested in connection with this

arbitration provision that allows either of us to

application or in connection with updates, renewals

elect to resolve, among other things, any claim,

Cash Advance

$5.00 or 3.5% of the total dollar amount advanced,

or extensions of any credit granted as a result of

controversy or dispute arising from or relating to

Fee

whichever is greater

this application. Upon request, you will be informed

the Card Agreement and your account (“Claim”)

Late Payment

$35 (at the time the Minimum Amount is due is not received

by arbitration, in which case neither of us

whether or not such a report was requested and, if

Fee

by the Payment Due Date and at monthly intervals thereafter

generally will have the right to have the Claim

so, the name and address of the agency that furnished

as long as the Minimum Payment due remains past due)

the report.

resolved by a judge or jury. You will not have the

Notice for Married Wisconsin Residents: Your

right to participate as a representative or member

Over Limit Fee

$35

signature confirms that this loan obligation is being

of any class of claimants pertaining to any claim,

incurred in the interest of your marriage or family. No

controversy or dispute subject to arbitration. Other

Balance

None

rights that you would have if you went to court may

provision of a marital property agreement, a unilateral

Transfer Fee

also not be available in arbitration. For additional

statement under Section 766.59 of the Wisconsin

Statutes or a court decree under Section 766.70 of the

information, see the Card Agreement or write to

Transaction

For all transactions made in a foreign currency, 3% of the

Fee for

Wisconsin Statutes adversely affects the interests of

us at: Card Center, P.O. Box 3038, Evansville, IN

U.S. dollar amount of each such Foreign Transaction that

Purchases

posts to your account.

the creditor unless the creditor, prior to the time the

47730-3038.

councilbluffs—cons04/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2