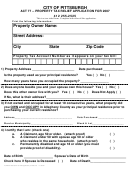

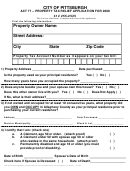

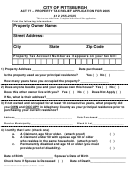

Home Owners Important Tax Information Enclosed, Property Tax Relief Application For Homestead And Farmstead Exclusions Page 3

ADVERTISEMENT

12. Only buildings and structures on farms which are at least ten contiguous acres in area and used as the primary residence of an owner

are eligible for a farmstead exclusion. Land is not eligible for the farmstead exclusion. If your property includes at least ten contiguous acres

of farm land, check yes.

13. Check yes if the buildings or structures are used primarily to:

a. Produce or store farm products produced on the farm for the purpose of commercial agricultural production.

b. House animals raised or maintained on the farm for the purpose of commercial agricultural production.

c. Store agricultural supplies or machinery and equipment used on the farm in commercial agricultural production.

14. Check yes if any farm buildings or structures receive an abatement of property tax under any other law.

CHANGE IN USE

If your property is approved as homestead or farmstead property and the use changes so that the property no longer qualifies for the homestead or

farmstead exclusion, you must notify the assessor within 45 days of the change in use. If the use of your property changes and you are not sure if it

still qualifies for the homestead or farmstead exclusion, you should contact the assessor.

FALSE OR FRAUDULENT APPLICATIONS

The assessor may select, randomly or otherwise, applications to review for false or fraudulent information. Any person who files an application that

contains false information, or who does not notify the assessor of a change in use which no longer qualifies as homestead or farmstead property, will:

• Be required to pay the taxes which would have been due but for the false application, plus interest.

• Be required to pay a penalty equal to 10% of the unpaid taxes.

• If convicted of filing a false application, be guilty of a misdemeanor of the third degree and be sentenced to pay a fine not exceeding $2,500.

This application must be signed by an owner for whom this property is his or her primary residence. If the property has more than one owner,

signatures of additional owners are not required. By signing this application, the applicant is affirming or swearing that all information contained in

the application is true and correct.

Applications must be filed on or before March 1 of each year unless an application has been filed within the preceding three years. Please return to:

Homestead Coordinator

Delaware County Board of Assessment

Courthouse and Government Center

201 West Front Street

Media, PA 19063

For questions on the Homestead or Farmstead Exclusion, please contact your local tax collector or the Delaware County Board of Assessment at

610-891-4893, office hours 8:30 a.m. to 4:30 p.m., Monday through Friday.

Instructions Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4