INSTRUCTIONS FOR POWER OF ATTORNEY AUTHORIZATION

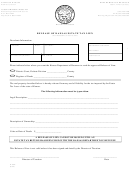

A power of attorney is a legal document authorizing someone to act as your representative. You - the taxpayer

must complete, sign, and return this form if you wish to grant a power of attorney (POA) to an attorney, accountant,

agent, tax return preparer, family member, or anyone else to act on your behalf with the Kansas Department of

Revenue. You may use this form for any matter affecting any tax administered by the department, including audit

and collection matters. This POA will remain in effect until the expiration date, if included under Section 2, or until

you revoke it, whichever is earlier. The department will accept copies of this form, including fax copies.

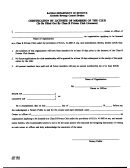

Retention/revocation of prior powers of attorney.

INSTRUCTIONS

Unless otherwise specified, this POA replaces and

revokes all previous POAs on file with the department.

S

1. T

I

.

ECTION

AXPAYER

NFORMATION

If there is an existing POA that you do NOT want to

revoke, check the box in this section and attach a

Individuals. In the block provided, enter your name,

copy of each POA that will remain in effect.

SSN, address, and telephone number in the spaces

If you wish to revoke an existing POA without

provided. If this POA is for a joint return and your

naming a new representative, attach a copy of the

spouse is designating the same representative or

previously executed POA.

On the copy of the

representatives, enter your spouse’s name and Social

previously executed POA, write “REVOKE” across the

Security number, and your spouse’s address if

top of the form, and initial and date it again under your

different from your own.

signature or signatures already in Section 3.

Businesses. Enter both the legal name and the DBA

or trade name, if different.

For example, if the

S

3. S

T

T

.

business is an individual proprietorship, enter the

ECTION

IGNATURE OF

AXPAYER OR

AXPAYERS

proprietor's name and the name under which business

is transacted. (e.g., Joe Smith dba Joe's Diner). Also

You must sign and date the POA. If a joint return is

enter the EIN (federal employer identification number),

being filed and both husband and wife intend to

the business address, and telephone number.

authorize the same person to represent them, both

Estates. Enter the name, title, and address of the

spouses must sign the POA unless one spouse has

decedent’s executor/personal representative in the

authorized the other in writing to sign for both. You must

taxpayer section. Use the spouse’s section to enter

attach a copy of your spouse's written authorization to

the decedent’s name, date of death, and SSN.

this POA.

S

2. T

P

A

.

ECTION

AXPAYER GRANT OF

OWER OF

TTORNEY

S

4. S

R

ECTION

IGNATURE

OF

EPRESENTATIVE

OR

.

REPRESENTATIVES

Representative's name. For this block, complete all

the requested information for each representative. If

Each representative that you name must sign and

the representative is a member of a firm, enter the

date this form.

firm’s name too. If you are designating more than two

representatives, please complete another form and

QUESTIONS?

attach it to this form. Mark the second form “additional

representatives.”

If you have questions about this form, please visit

Type of tax. For this block, enter the type of tax and

or call our office.

the tax years or reporting periods for each tax type. If

you wish the power of attorney to apply to all periods

Taxpayer Assistance Center

and all tax types administered by the department,

st

Docking State Office Building, 1

Floor

please enter "All tax types" in the block for "Type of

915 SW Harrison St.

Tax" and "All tax periods" in the block for "Year(s) or

Topeka, KS 66612

Period(s)." If the matter relates to estate, inheritance,

Phone: (785) 368-8222

or succession tax, please enter the date of the

Hearing Impaired TTY: (785) 296-6461

decedent’s death.

Authorized acts. Check all boxes that apply. Use

The Department of Revenue office hours are 8:00

the additional lines to limit, clarify, or otherwise define

a.m. to 5:00 p.m., Monday through Friday.

the acts authorized by this POA. For example, if you

wish to limit the POA to a specific time period or to

Additional copies of this form are available from

establish an expiration date, enter that information

our web site at

and the dates (month, day, and year) on these lines.

1

1 2

2