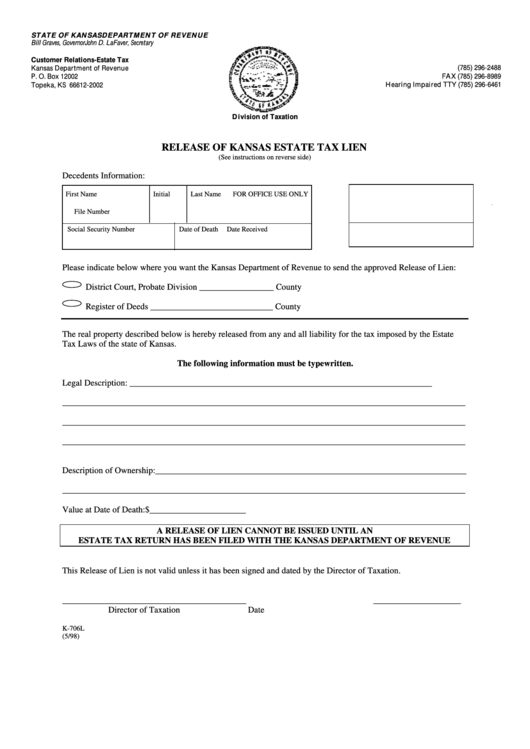

STATE OF KANSAS

DEPARTMENT OF REVENUE

Bill Graves, Governor

John D. LaFaver, Secretary

Customer Relations-Estate Tax

(785) 296-2488

Kansas Department of Revenue

FAX (785) 296-8989

P. O. Box 12002

Hearing Impaired TTY (785) 296-6461

Topeka, KS 66612-2002

Division of Taxation

RELEASE OF KANSAS ESTATE TAX LIEN

(See instructions on reverse side)

Decedents Information:

First Name

Initial

Last Name

FOR OFFICE USE ONLY

File Number

Social Security Number

Date of Death

Date Received

Please indicate below where you want the Kansas Department of Revenue to send the approved Release of Lien:

District Court, Probate Division _________________ County

Register of Deeds ____________________________ County

The real property described below is hereby released from any and all liability for the tax imposed by the Estate

Tax Laws of the state of Kansas.

The following information must be typewritten.

Legal Description: _____________________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

Description of Ownership: _______________________________________________________________________

____________________________________________________________________________________________

Value at Date of Death: $______________________

A RELEASE OF LIEN CANNOT BE ISSUED UNTIL AN

ESTATE TAX RETURN HAS BEEN FILED WITH THE KANSAS DEPARTMENT OF REVENUE

This Release of Lien is not valid unless it has been signed and dated by the Director of Taxation.

__________________________________________

____________________

Director of Taxation

Date

K-706L

(5/98)

1

1