INSTRUCTIONS FOR COMPLETING VERMONT DEPARTMENT OF TAXES

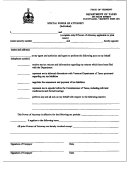

SPECIAL POWER OF ATTORNEY (POA).

FOR INDIVIDUAL AND JOINT FILERS

A new law (14 V.S.A. Chapter 123) concerning POAs became effective July 1, 2002. All POAs submitted to the

Department of Taxes beginning July 1, 2002 must comply with the new law. However, any POA executed prior to July 1,

2002 and valid under law then in effect will continue to be valid.

The most important changes concern the execution of a POA. A POA filed July 1, 2002 or later which does not comply

with the new execution requirements will not be valid. In order to be valid, every Vermont Department of Taxes Special

POA must meet all of the following execution requirements:

1) POAs must be signed by the principal in the presence of at least one witness and acknowledged before a notary public,

who cannot be the same person as the witness. The person named as agent cannot serve as witness or notary. THE

DEPARTMENT OF TAXES WILL NOT ACCEPT POAS WHERE THE WITNESS AND NOTARY ARE

THE SAME PERSON.

2) The witness must affirm that the principal appeared to be of sound mind and free from duress at the time of signing and

that the principal affirmed that he/she was aware of the nature of the document and signed it freely and voluntarily.

3) POAs also must be signed by the agent. This does not have to happen at the same time the principal signs, but must

happen before the POA can be used. THE DEPARTMENT OF TAXES WILL NOT ACCEPT POAS UN-

LESS SIGNED BY THE AGENT.

4) When signing, an agent must attest that he/she accepts appointment as agent and understands the duties of agent, both

under the POA and under the law. In addition, there are two optional provisions, which, if chosen in a POA, require

attestation by agents. First, if a POA gives an agent a duty to act as to the powers given (as opposed to merely the

authority to act), the agent must attest that he/she understands that duty. Second, if the agent is expected to use special

skills or expertise on behalf of the principal, he/she must so attest.

1

1 2

2 3

3 4

4