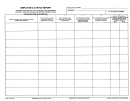

Family Medical Leave Act (Fmla) And Oregon Family Leave Act (Ofla) Forms Packet, Form Cd 1422 - Employee Medical Status Report Page 10

ADVERTISEMENT

b. Hardship donations can only be requested once all leave has been exhausted. If

you are banking leave time, you will not be eligible for hardship donations until the

leave is exhausted.

4. Core Benefits

a. Medical, Dental, Vision, and Basic Life Insurance are considered the core benefits

provided by the state. While under protected leave (FMLA/SAIF/Military) the state

will continue to pay its portion toward premium payments. You may also be eligible

under the Affordable Care Act to have DOC continue to pay its premiums

share.You are still responsible to continue payment of your share of the premium.

b. If you are receiving a check from DOC, and are paid a minimum of 80 hours, your

premium payments are automatically paid from your wages.

c. If you fall below 80 paid hours or are in LWOP, a letter will be mailed to you

detailing the coverage benefits you have, the amount necessary to maintain

coverage, and how to make the necessary payments each month. Please contact

payroll with questions.

d. If you choose not to continue core insurance coverage while you are out, you need

to request in writing to terminate coverage, but it will then affect any medical

services while you’re out.

5.

Optional Insurance Benefits

a. Continued payment and coverage for the following are handled the same as the

core benefits, except these may be paid for up to 1 year as long as your remain

employed, without the FMLA/SAIF/Military/ACA stipulation.

i. Accidental Death and Dismemberment

ii. Flexible Spending Account (Health and Dependent) can be prepaid with

prior approval or reenrolled in when you return to work.

iii. Domestic Partner Tax (if the partner continues to be covered for core

benefits)

iv. UNUM, Long Term Care Insurance

v. Assurant Insurance

vi. Optional Life Insurance, self and spouse and/or partner

vii. Dependent Life

viii. Short Term and Long Term Disability – if you currently have an active claim,

no premiums are due while the claim is open. These are only payable for 90

days.

b. If you are receiving a check from DOC, and are paid a minimum of 80 hours, your

premium payments are automatically recovered from your wages.

c. If you fall below 80 hours or are in LWOP, a letter will be mailed to you detailing the

optional coverage benefits you have, the amount necessary to maintain coverage,

and how to make the necessary payments each month. Please contact payroll at

the number above with questions.

d. If you choose not to continue optional insurance coverage while you are out, you

need to request in writing to terminate coverage, but it will then affect the use of

disability coverage while you’re out.

Created by Payroll/FMLA

Payroll Unit

Updated: 07/01/15

Fiscal Services

v.5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12