Uniform Residential Loan Application Page 4

ADVERTISEMENT

FARM CREDIT EAST, ACA

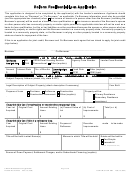

VII. DETAILS OF TRANSACTION

VIII. DECLARATIONS

If you answer “yes” to any questions a through i,

a. Purchase Price

$

Borrower

Co-Borrower

b. Alterations, improvements, repairs

please use continuation sheet for explanation.

Yes

No

Yes

No

c. Land (if acquired separately)

d. Refinance (include. debts to be paid off)

a. Are there any outstanding judgments against you?

e. Estimated prepaid items

b. Have you been declared bankrupt within the past 7 years?

f. Estimated closing costs

c. Have you had property foreclosed upon or given title or

g. PMI, MIP, Funding Fee

deed in lieu thereof in the last 7 years.

h. Discount (if Borrower will pay)

d. Are you a party to a lawsuit?

i. Total costs (add items a through h)

e. Have you directly or indirectly been obligated on any loan which resulted in foreclosure, transfer

j. Subordinate financing

of title in lieu of foreclosure, or judgment? (This would include such loans as home mortgage loans,

k. Borrower’s closing costs paid by Seller

SBA loans, home improvement loans, educational loans, manufactured (mobile) home loans, any

mortgage, financial obligation, bond, or loan guarantee. If “yes” provide details, including date,

name and address of Lender, FHA or VA case number, if any, and reasons for this action.)

l. Other credits (explain)

and reasons for the action.)

f. Are you presently delinquent or in default on any Federal debt or any other loan, mortgage, financial

obligation, bond or loan guarantee? If “Yes” give details as described in the preceding

question.

g. Are you obligated to pay alimony, child support or separate

maintenance?

h. Is any part of the down payment borrowed?

i. Are you a co-maker or endorser on a note?

m. Loan amount (exclude PMI, MIP, Funding Fee

j. Are you a U.S. Citizen?

Financed).

n. Required purchase of Association Equity

k. Are you a permanent resident alien?

l. Do you intend to occupy the property as your primary

o. PMI, MIP, Funding Fee Financed

residence? If yes, complete question m below.

m. Have you had an ownership interest in a property in the past

p. Loan amount (add m, n, o)

three years?

1. What type of property did you own -principal residence

q. Cash from/to Borrower

(PR), second home (SH) or investment property (IP)

2. How did you hold title to the home -Solely by yourself

(S), jointly with spouse (SP) or jointly with another

person (O)?

IX. ACKNOWLEDGMENT AND AGREEMENT

Each of the undersigned specifically represents to Lender and to Lender’s actual or potential agents, brokers, processors, attorneys, insurers, servicers, successors and

assigns and agrees and acknowledges that: (1) the information provided in this application is true and correct as of the date set forth opposite my signature and that any

intentional or negligent misrepresentation of the information contained in this application may result in civil liability, including monetary damages, to any person who

may suffer any loss due to reliance upon any misrepresentation that I have made on this application, and/or in criminal penalties including, but not limited to, fine or

imprisonment or both under the provisions of Title 18, United States Code, Sec. 1001, et seq.; (2) the loan requested pursuant to this application (the, “Loan”) will be

secured by a mortgage or deed of trust on the property described in this application; (3) the property will not be used for any illegal or prohibited purpose or use; (4) all

statements made in this application are made for the purpose of obtaining a residential mortgage loan; (5) the property will be occupied as indicated in this application;

(6) the Lender, its servicers, successors or assigns may retain the original and/or electronic record of this application, whether or not the Loan is approved; (7) the

Lender and its agents, brokers, insurers, servicers, successors and assigns may continuously rely on the information contained in the application, and I am obligated to

amend and/or supplement the information provided in this application if any of the material facts that I have represented herein should change prior to closing of the

Loan; (8) in the event that my payments on the Loan become delinquent, the Lender, its servicers, successors or assigns may, in addition to any other rights or remedies

that it may have relating to such delinquency, report my name and account information to one or more consumer credit reporting agencies; (9) ownership of the Loan

and/or administration of the Loan account may be transferred with such notice as may be required by law; (10) neither Lender or its agents, brokers, insurers, servicers,

successors or assigns has made any representation or warranty, express or implied, to me regarding the property or the condition or the value of the property; and (11)

my transmission of this application is an “electronic record” containing my “electronic signature” as those terms are defined in applicable federal and/or state laws

(excluding audio and video recordings), or my facsimile transmission of this application containing a facsimile of my signature shall be as effective, enforceable and

valid as if the paper version of this application were delivered containing my signed written signature.

Acknowledgment. Each of the undersigned hereby acknowledges that any owner of the Loan, its servicers, successors and assigns, may verify or reverify any

information contained in this application or obtain any information or data relating to the Loan, for any legitimate business purpose through any source, including a

source named in this application or a consumer reporting agency.

Borrower’s Signature

Co-Borrower’s Signature

Date

Date

___________________________________________________

___________________________________________________

Freddie Mac 07/05

Page 4 of 6

Fannie Mae Form 1003 07/05

1003

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6