Instructions For Form 8810 (2015)

ADVERTISEMENT

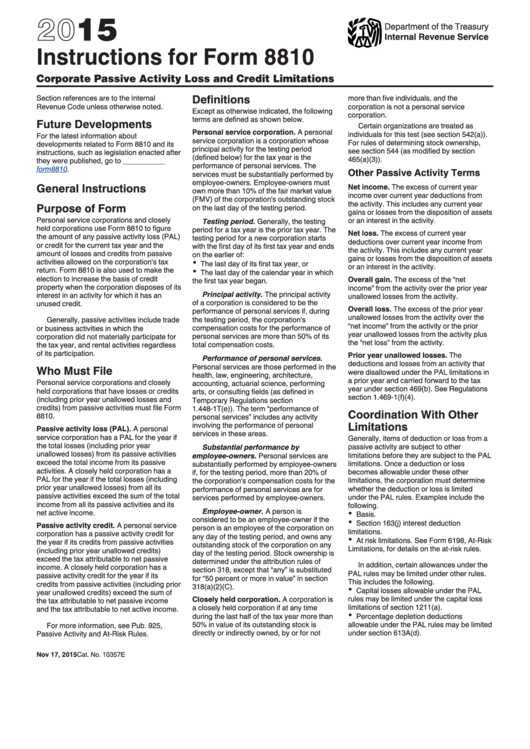

2015

Department of the Treasury

Internal Revenue Service

Instructions for Form 8810

Corporate Passive Activity Loss and Credit Limitations

Definitions

Section references are to the Internal

more than five individuals, and the

Revenue Code unless otherwise noted.

corporation is not a personal service

Except as otherwise indicated, the following

corporation.

terms are defined as shown below.

Future Developments

Certain organizations are treated as

Personal service corporation. A personal

individuals for this test (see section 542(a)).

For the latest information about

service corporation is a corporation whose

For rules of determining stock ownership,

developments related to Form 8810 and its

principal activity for the testing period

see section 544 (as modified by section

instructions, such as legislation enacted after

(defined below) for the tax year is the

465(a)(3)).

they were published, go to

performance of personal services. The

form8810.

Other Passive Activity Terms

services must be substantially performed by

employee-owners. Employee-owners must

General Instructions

Net income. The excess of current year

own more than 10% of the fair market value

income over current year deductions from

(FMV) of the corporation's outstanding stock

the activity. This includes any current year

Purpose of Form

on the last day of the testing period.

gains or losses from the disposition of assets

Personal service corporations and closely

or an interest in the activity.

Testing period. Generally, the testing

held corporations use Form 8810 to figure

period for a tax year is the prior tax year. The

Net loss. The excess of current year

the amount of any passive activity loss (PAL)

testing period for a new corporation starts

deductions over current year income from

or credit for the current tax year and the

with the first day of its first tax year and ends

the activity. This includes any current year

amount of losses and credits from passive

on the earlier of:

gains or losses from the disposition of assets

activities allowed on the corporation's tax

The last day of its first tax year, or

or an interest in the activity.

return. Form 8810 is also used to make the

The last day of the calendar year in which

election to increase the basis of credit

Overall gain. The excess of the “net

the first tax year began.

property when the corporation disposes of its

income” from the activity over the prior year

Principal activity. The principal activity

interest in an activity for which it has an

unallowed losses from the activity.

of a corporation is considered to be the

unused credit.

Overall loss. The excess of the prior year

performance of personal services if, during

unallowed losses from the activity over the

Generally, passive activities include trade

the testing period, the corporation's

“net income” from the activity or the prior

or business activities in which the

compensation costs for the performance of

year unallowed losses from the activity plus

corporation did not materially participate for

personal services are more than 50% of its

the “net loss” from the activity.

the tax year, and rental activities regardless

total compensation costs.

of its participation.

Prior year unallowed losses. The

Performance of personal services.

deductions and losses from an activity that

Personal services are those performed in the

Who Must File

were disallowed under the PAL limitations in

health, law, engineering, architecture,

a prior year and carried forward to the tax

Personal service corporations and closely

accounting, actuarial science, performing

year under section 469(b). See Regulations

held corporations that have losses or credits

arts, or consulting fields (as defined in

section 1.469-1(f)(4).

(including prior year unallowed losses and

Temporary Regulations section

credits) from passive activities must file Form

1.448-1T(e)). The term “performance of

Coordination With Other

8810.

personal services” includes any activity

Limitations

involving the performance of personal

Passive activity loss (PAL). A personal

services in these areas.

service corporation has a PAL for the year if

Generally, items of deduction or loss from a

the total losses (including prior year

passive activity are subject to other

Substantial performance by

unallowed losses) from its passive activities

limitations before they are subject to the PAL

employee-owners. Personal services are

exceed the total income from its passive

limitations. Once a deduction or loss

substantially performed by employee-owners

activities. A closely held corporation has a

becomes allowable under these other

if, for the testing period, more than 20% of

PAL for the year if the total losses (including

limitations, the corporation must determine

the corporation's compensation costs for the

prior year unallowed losses) from all its

whether the deduction or loss is limited

performance of personal services are for

passive activities exceed the sum of the total

under the PAL rules. Examples include the

services performed by employee-owners.

income from all its passive activities and its

following.

Employee-owner. A person is

net active income.

Basis.

considered to be an employee-owner if the

Section 163(j) interest deduction

Passive activity credit. A personal service

person is an employee of the corporation on

limitations.

corporation has a passive activity credit for

any day of the testing period, and owns any

At risk limitations. See Form 6198, At-Risk

the year if its credits from passive activities

outstanding stock of the corporation on any

Limitations, for details on the at-risk rules.

(including prior year unallowed credits)

day of the testing period. Stock ownership is

exceed the tax attributable to net passive

determined under the attribution rules of

In addition, certain allowances under the

income. A closely held corporation has a

section 318, except that “any” is substituted

PAL rules may be limited under other rules.

passive activity credit for the year if its

for “50 percent or more in value” in section

This includes the following.

credits from passive activities (including prior

318(a)(2)(C).

Capital losses allowable under the PAL

year unallowed credits) exceed the sum of

rules may be limited under the capital loss

Closely held corporation. A corporation is

the tax attributable to net passive income

limitations of section 1211(a).

a closely held corporation if at any time

and the tax attributable to net active income.

during the last half of the tax year more than

Percentage depletion deductions

50% in value of its outstanding stock is

allowable under the PAL rules may be limited

For more information, see Pub. 925,

directly or indirectly owned, by or for not

under section 613A(d).

Passive Activity and At-Risk Rules.

Nov 17, 2015

Cat. No. 10357E

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14