Instructions For Form 4720 (2015)

ADVERTISEMENT

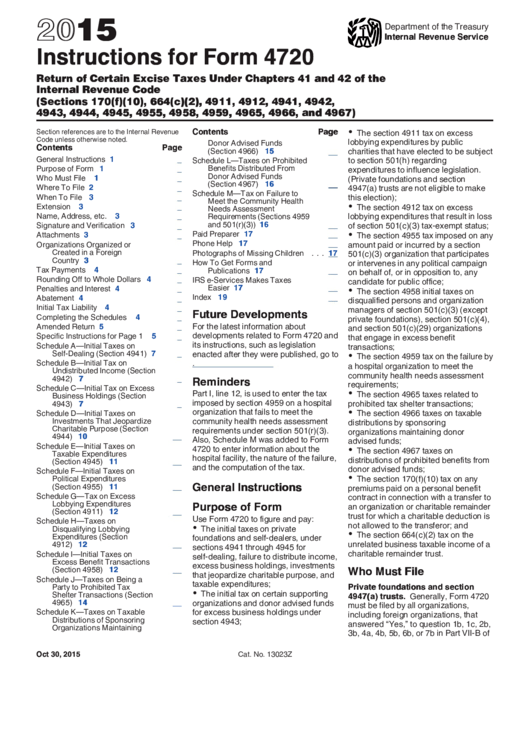

2015

Department of the Treasury

Internal Revenue Service

Instructions for Form 4720

Return of Certain Excise Taxes Under Chapters 41 and 42 of the

Internal Revenue Code

(Sections 170(f)(10), 664(c)(2), 4911, 4912, 4941, 4942,

4943, 4944, 4945, 4955, 4958, 4959, 4965, 4966, and 4967)

Contents

Page

Section references are to the Internal Revenue

The section 4911 tax on excess

Code unless otherwise noted.

lobbying expenditures by public

Donor Advised Funds

Contents

Page

(Section 4966) . . . . . . . . . . . .

15

charities that have elected to be subject

General Instructions . . . . . . . . . . . . .

1

to section 501(h) regarding

Schedule L—Taxes on Prohibited

Purpose of Form . . . . . . . . . . . . . . .

1

Benefits Distributed From

expenditures to influence legislation.

Donor Advised Funds

Who Must File . . . . . . . . . . . . . . . .

1

(Private foundations and section

(Section 4967) . . . . . . . . . . . .

16

Where To File . . . . . . . . . . . . . . . . .

2

4947(a) trusts are not eligible to make

Schedule M—Tax on Failure to

When To File . . . . . . . . . . . . . . . . .

3

this election);

Meet the Community Health

Extension . . . . . . . . . . . . . . . . . . .

3

The section 4912 tax on excess

Needs Assessment

Name, Address, etc. . . . . . . . . . . . .

3

lobbying expenditures that result in loss

Requirements (Sections 4959

and 501(r)(3)) . . . . . . . . . . . . .

16

Signature and Verification . . . . . . . . .

3

of section 501(c)(3) tax-exempt status;

Paid Preparer . . . . . . . . . . . . . . . .

17

Attachments . . . . . . . . . . . . . . . . . .

3

The section 4955 tax imposed on any

Phone Help . . . . . . . . . . . . . . . . .

17

amount paid or incurred by a section

Organizations Organized or

Created in a Foreign

Photographs of Missing Children . . .

17

501(c)(3) organization that participates

Country . . . . . . . . . . . . . . . . . .

3

How To Get Forms and

or intervenes in any political campaign

Tax Payments . . . . . . . . . . . . . . . .

4

Publications . . . . . . . . . . . . . .

17

on behalf of, or in opposition to, any

Rounding Off to Whole Dollars . . . . . .

4

IRS e-Services Makes Taxes

candidate for public office;

Easier . . . . . . . . . . . . . . . . . .

17

Penalties and Interest . . . . . . . . . . . .

4

The section 4958 initial taxes on

Index . . . . . . . . . . . . . . . . . . . . .

19

Abatement . . . . . . . . . . . . . . . . . . .

4

disqualified persons and organization

Initial Tax Liability . . . . . . . . . . . . . .

4

managers of section 501(c)(3) (except

Future Developments

Completing the Schedules

. . . . . . . .

4

private foundations), section 501(c)(4),

For the latest information about

Amended Return . . . . . . . . . . . . . . .

5

and section 501(c)(29) organizations

developments related to Form 4720 and

Specific Instructions for Page 1

. . . . .

5

that engage in excess benefit

its instructions, such as legislation

Schedule A—Initial Taxes on

transactions;

Self-Dealing (Section 4941) . . . . .

7

enacted after they were published, go to

The section 4959 tax on the failure by

Schedule B—Initial Tax on

a hospital organization to meet the

Undistributed Income (Section

community health needs assessment

4942) . . . . . . . . . . . . . . . . . . .

7

Reminders

requirements;

Schedule C—Initial Tax on Excess

Part I, line 12, is used to enter the tax

The section 4965 taxes related to

Business Holdings (Section

imposed by section 4959 on a hospital

prohibited tax shelter transactions;

4943) . . . . . . . . . . . . . . . . . . .

7

organization that fails to meet the

The section 4966 taxes on taxable

Schedule D—Initial Taxes on

Investments That Jeopardize

community health needs assessment

distributions by sponsoring

Charitable Purpose (Section

requirements under section 501(r)(3).

organizations maintaining donor

4944) . . . . . . . . . . . . . . . . . .

10

Also, Schedule M was added to Form

advised funds;

Schedule E—Initial Taxes on

4720 to enter information about the

The section 4967 taxes on

Taxable Expenditures

hospital facility, the nature of the failure,

distributions of prohibited benefits from

(Section 4945) . . . . . . . . . . . .

11

and the computation of the tax.

donor advised funds;

Schedule F—Initial Taxes on

The section 170(f)(10) tax on any

Political Expenditures

General Instructions

(Section 4955) . . . . . . . . . . . .

11

premiums paid on a personal benefit

Schedule G—Tax on Excess

contract in connection with a transfer to

Lobbying Expenditures

Purpose of Form

an organization or charitable remainder

(Section 4911) . . . . . . . . . . . .

12

trust for which a charitable deduction is

Use Form 4720 to figure and pay:

Schedule H—Taxes on

not allowed to the transferor; and

The initial taxes on private

Disqualifying Lobbying

The section 664(c)(2) tax on the

Expenditures (Section

foundations and self-dealers, under

unrelated business taxable income of a

4912) . . . . . . . . . . . . . . . . . .

12

sections 4941 through 4945 for

charitable remainder trust.

Schedule I—Initial Taxes on

self-dealing, failure to distribute income,

Excess Benefit Transactions

excess business holdings, investments

Who Must File

(Section 4958) . . . . . . . . . . . .

12

that jeopardize charitable purpose, and

Schedule J—Taxes on Being a

taxable expenditures;

Party to Prohibited Tax

Private foundations and section

The initial tax on certain supporting

Shelter Transactions (Section

4947(a) trusts. Generally, Form 4720

4965) . . . . . . . . . . . . . . . . . .

14

organizations and donor advised funds

must be filed by all organizations,

Schedule K—Taxes on Taxable

for excess business holdings under

including foreign organizations, that

Distributions of Sponsoring

section 4943;

answered “Yes,” to question 1b, 1c, 2b,

Organizations Maintaining

3b, 4a, 4b, 5b, 6b, or 7b in Part VII-B of

Oct 30, 2015

Cat. No. 13023Z

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19