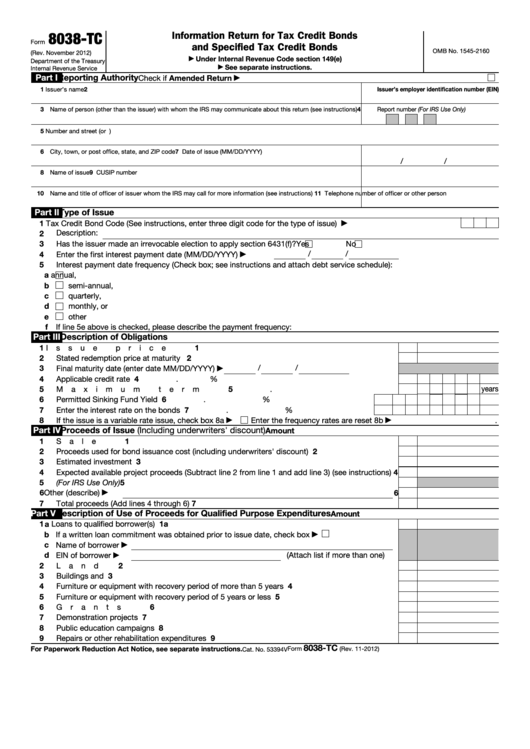

Form 8038-Tc - Information Return For Tax Credit Bonds

ADVERTISEMENT

8038-TC

Information Return for Tax Credit Bonds

Form

and Specified Tax Credit Bonds

OMB No. 1545-2160

(Rev. November 2012)

Under Internal Revenue Code section 149(e)

▶

Department of the Treasury

See separate instructions.

Internal Revenue Service

▶

Part I

Reporting Authority

Check if Amended Return

▶

1 Issuer’s name

2 Issuer’s employer identification number (EIN)

3 Name of person (other than the issuer) with whom the IRS may communicate about this return (see instructions)

4 Report number (For IRS Use Only)

5 Number and street (or P.O. Box if mail is not delivered to street address)

6 City, town, or post office, state, and ZIP code

7 Date of issue (MM/DD/YYYY)

/

/

8 Name of issue

9 CUSIP number

10 Name and title of officer of issuer whom the IRS may call for more information (see instructions)

11 Telephone number of officer or other person

Part II

Type of Issue

1

Tax Credit Bond Code (See instructions, enter three digit code for the type of issue) .

.

.

.

.

.

.

.

.

▶

Description:

2

3

Has the issuer made an irrevocable election to apply section 6431(f)?

Yes

No

/

/

4

Enter the first interest payment date (MM/DD/YYYY)

▶

5

Interest payment date frequency (Check box; see instructions and attach debt service schedule):

a

annual,

b

semi-annual,

c

quarterly,

d

monthly, or

e

other

f If line 5e above is checked, please describe the payment frequency:

Part III

Description of Obligations

1

Issue price

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2

2

Stated redemption price at maturity .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

/

/

Final maturity date (enter date MM/DD/YYYY)

▶

4

Applicable credit rate .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

.

%

5

5

years

Maximum term .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

6

Permitted Sinking Fund Yield

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

%

7

Enter the interest rate on the bonds .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

.

%

8

If the issue is a variable rate issue, check box 8a

Enter the frequency rates are reset 8b

.

▶

▶

Part IV

Proceeds of Issue (Including underwriters' discount)

Amount

1

Sale Proceeds .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2

Proceeds used for bond issuance cost (including underwriters' discount) .

.

.

.

.

.

.

.

2

3

3

Estimated investment proceeds

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

Expected available project proceeds (Subtract line 2 from line 1 and add line 3) (see instructions)

4

5

(For IRS Use Only) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6

Other (describe)

6

▶

7

Total proceeds (Add lines 4 through 6)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Part V

Description of Use of Proceeds for Qualified Purpose Expenditures

Amount

1 a Loans to qualified borrower(s) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1a

b If a written loan commitment was obtained prior to issue date, check box

▶

c Name of borrower

▶

d EIN of borrower

(Attach list if more than one)

▶

2

2

Land

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Buildings and structures .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Furniture or equipment with recovery period of more than 5 years

.

.

.

.

.

.

.

.

.

.

4

5

5

Furniture or equipment with recovery period of 5 years or less

.

.

.

.

.

.

.

.

.

.

.

6

Grants .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

Demonstration projects .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

8

Public education campaigns

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

9

Repairs or other rehabilitation expenditures

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8038-TC

For Paperwork Reduction Act Notice, see separate instructions.

Form

(Rev. 11-2012)

Cat. No. 53394V

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5