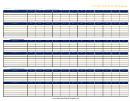

Cash Flow Statement Page 9

ADVERTISEMENT

MODULE - 6A

Cash Flow Statement

Analysis of Financial Statements

(iii) Cash flows are classified in to three i.e. operating activities, financing

activities and ........................ activities.

(iv) SEBI guidelines recommend only ........................ method for preparing

cash flow statement.

Notes

30.3 PREPARATION OF CASH FLOW STATEMENT

(i) Operating Activities

Cash flow from operating activities are primarily derived from the principal

revenue generating activities of the enterprise. A few items of cash flows

from operating activities are :

(i) Cash receipt from the sale of goods and rendering services.

(ii) Cash receipts from royalties, fee, Commissions and other revenue.

(iii) Cash payments to suppliers for goods and services.

(iv) Cash payment to employees

(vi) Cash payment or refund of Income tax.

Determination of cash flow from operating activities

There are two stages for arriving at the cash flow from operating activities

Stage-1

Calculation of operating profit before working capital changes, It can be

calculated in the following manner.

Net profit before Tax and extra ordinary Items

xxx

Add Non-cash and non operating Items

which have already been debited to profit and Loss Account i.e.

Depreciation

xxx

Amortisation of intangible assets

xxx

Loss on the sale of Fixed assets.

xxx

Loss on the sale of Long term Investments

xxx

Provision for tax

xxx

Dividend paid

xxx

xxx

xxx

70

ACCOUNTANCY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30