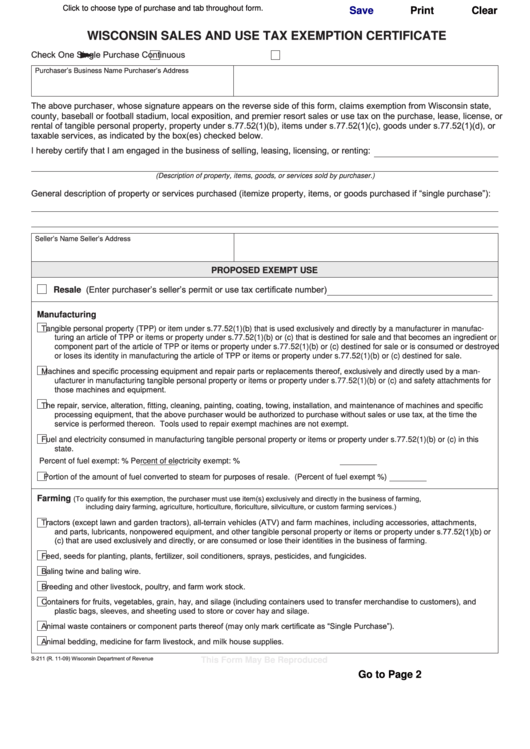

Click to choose type of purchase and tab throughout form.

Save

Print

Clear

WISCONSIN SALES AND USE TAX EXEMPTION CERTIFICATE

Check One

Single Purchase

Continuous

Purchaser’s Address

Purchaser’s Business Name

The above purchaser, whose signature appears on the reverse side of this form, claims exemption from Wisconsin state,

county, baseball or football stadium, local exposition, and premier resort sales or use tax on the purchase, lease, license, or

rental of tangible personal property, property under s.77.52(1)(b), items under s.77.52(1)(c), goods under s.77.52(1)(d), or

taxable services, as indicated by the box(es) checked below.

I hereby certify that I am engaged in the business of selling, leasing, licensing, or renting:

(Description of property, items, goods, or services sold by purchaser.)

General description of property or services purchased (itemize property, items, or goods purchased if “single purchase”):

Seller’s Address

Seller’s Name

PROPOSED EXEMPT USE

Resale (Enter purchaser’s seller’s permit or use tax certificate number)

Manufacturing

Tangible personal property (TPP) or item under s.77.52(1)(b) that is used exclusively and directly by a manufacturer in manufac-

turing an article of TPP or items or property under s.77.52(1)(b) or (c) that is destined for sale and that becomes an ingredient or

component part of the article of TPP or items or property under s.77.52(1)(b) or (c) destined for sale or is consumed or destroyed

or loses its identity in manufacturing the article of TPP or items or property under s.77.52(1)(b) or (c) destined for sale.

Machines and specific processing equipment and repair parts or replacements thereof, exclusively and directly used by a man-

ufacturer in manufacturing tangible personal property or items or property under s.77.52(1)(b) or (c) and safety attachments for

those machines and equipment.

The repair, service, alteration, fitting, cleaning, painting, coating, towing, installation, and maintenance of machines and specific

processing equipment, that the above purchaser would be authorized to purchase without sales or use tax, at the time the

service is performed thereon. Tools used to repair exempt machines are not exempt.

Fuel and electricity consumed in manufacturing tangible personal property or items or property under s.77.52(1)(b) or (c) in this

state.

Percent of fuel exempt:

%

Percent of electricity exempt:

%

Portion of the amount of fuel converted to steam for purposes of resale. (Percent of fuel exempt

%)

(To qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming,

Farming

including dairy farming, agriculture, horticulture, floriculture, silviculture, or custom farming services.)

Tractors (except lawn and garden tractors), all-terrain vehicles (ATV) and farm machines, including accessories, attachments,

and parts, lubricants, nonpowered equipment, and other tangible personal property or items or property under s.77.52(1)(b) or

(c) that are used exclusively and directly, or are consumed or lose their identities in the business of farming.

Feed, seeds for planting, plants, fertilizer, soil conditioners, sprays, pesticides, and fungicides.

Baling twine and baling wire.

Breeding and other livestock, poultry, and farm work stock.

Containers for fruits, vegetables, grain, hay, and silage (including containers used to transfer merchandise to customers), and

plastic bags, sleeves, and sheeting used to store or cover hay and silage.

Animal waste containers or component parts thereof (may only mark certificate as “Single Purchase”).

Animal bedding, medicine for farm livestock, and milk house supplies.

S-211 (R. 11-09)

Wisconsin Department of Revenue

This Form May Be Reproduced

Go to Page 2

1

1 2

2 3

3 4

4