Form S-103 - Application For Wisconsin Sales And Use Tax Certificate Of Exempt Status (Ces)

ADVERTISEMENT

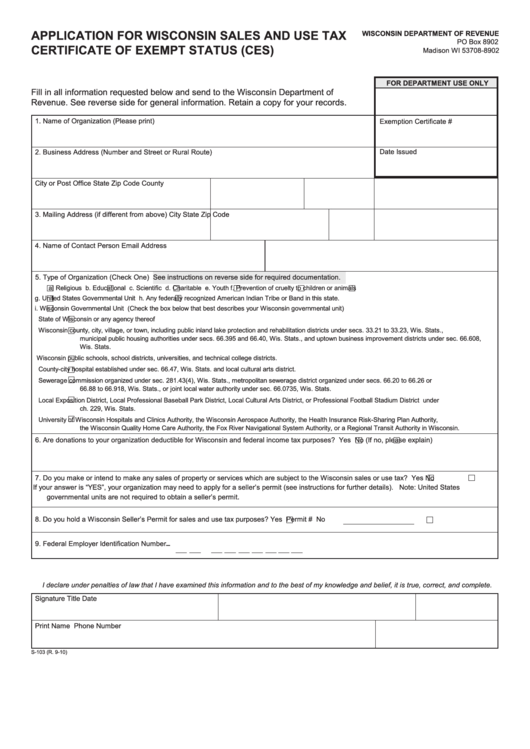

APPLICATION FOR WISCONSIN SALES AND USE TAX

WISCONSIN DEPARTMENT OF REVENUE

PO Box 8902

CERTIFICATE OF EXEMPT STATUS (CES)

Madison WI 53708-8902

FOR DEPARTMENT USE ONLY

Fill in all information requested below and send to the Wisconsin Department of

Revenue. See reverse side for general information. Retain a copy for your records.

1. Name of Organization (Please print)

Exemption Certificate #

2. Business Address (Number and Street or Rural Route)

Date Issued

City or Post Office

State

Zip Code

County

3. Mailing Address (if different from above)

City

State

Zip Code

4. Name of Contact Person

Email Address

5. Type of Organization (Check One) See instructions on reverse side for required documentation.

a. Religious

b. Educational

c. Scientific

d. Charitable

e. Youth

f. Prevention of cruelty to children or animals

g. United States Governmental Unit

h. Any federally recognized American Indian Tribe or Band in this state.

i. Wisconsin Governmental Unit (Check the box below that best describes your Wisconsin governmental unit)

State of Wisconsin or any agency thereof

Wisconsin county, city, village, or town, including public inland lake protection and rehabilitation districts under secs. 33.21 to 33.23, Wis. Stats.,

municipal public housing authorities under secs. 66.395 and 66.40, Wis. Stats., and uptown business improvement districts under sec. 66.608,

Wis. Stats.

Wisconsin public schools, school districts, universities, and technical college districts.

County-city hospital established under sec. 66.47, Wis. Stats. and local cultural arts district.

Sewerage commission organized under sec. 281.43(4), Wis. Stats., metropolitan sewerage district organized under secs. 66.20 to 66.26 or

66.88 to 66.918, Wis. Stats., or joint local water authority under sec. 66.0735, Wis. Stats.

Local Exposition District, Local Professional Baseball Park District, Local Cultural Arts District, or Professional Football Stadium District under

ch. 229, Wis. Stats.

University of Wisconsin Hospitals and Clinics Authority, the Wisconsin Aerospace Authority, the Health Insurance Risk-Sharing Plan Authority,

the Wisconsin Quality Home Care Authority, the Fox River Navigational System Authority, or a Regional Transit Authority in Wisconsin.

6. Are donations to your organization deductible for Wisconsin and federal income tax purposes?

Yes

No

(If no, please explain)

7. Do you make or intend to make any sales of property or services which are subject to the Wisconsin sales or use tax?

Yes

No

If your answer is “YES”, your organization may need to apply for a seller’s permit (see instructions for further details). Note: United States

governmental units are not required to obtain a seller’s permit.

8. Do you hold a Wisconsin Seller’s Permit for sales and use tax purposes?

Yes Permit #

No

–

9. Federal Employer Identification Number

I declare under penalties of law that I have examined this information and to the best of my knowledge and belief, it is true, correct, and complete.

Signature

Title

Date

Print Name

Phone Number

S-103 (R. 9-10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2