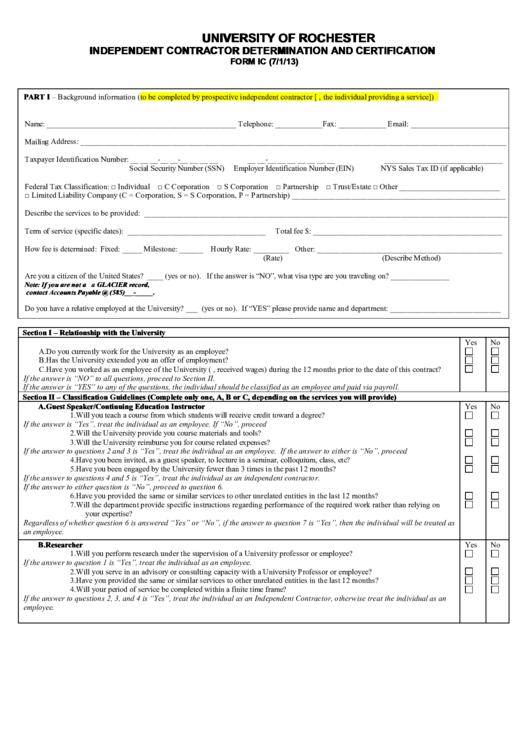

University Of Rochester Independent Contractor Determination And Certification Form Ic (7/1/13)

ADVERTISEMENT

UNIVERSITY OF ROCHESTER

INDEPENDENT CONTRACTOR DETERMINATION AND CERTIFICATION

FORM IC (7/1/13)

PART I – Background information (to be completed by prospective independent contractor [i.e., the individual providing a service])

Name: ________________________________________________ Telephone: ____________Fax: ____________ Email: _________________________

Mailing Address: ____________________________________________________________________________________________________________

Taxpayer Identification Number: __ __ __-__ __-__ __ __ __

__ __-__ __ __ __ __ __ __

______________________________

Social Security Number (SSN)

Employer Identification Number (EIN)

NYS Sales Tax ID (if applicable)

Federal Tax Classification: □ Individual □ C Corporation □ S Corporation □ Partnership □ Trust/Estate □ Other __________________________

□ Limited Liability Company (C = Corporation, S = S Corporation, P = Partnership) ______________________________________________________

Describe the services to be provided: ____________________________________________________________________________________________

Term of service (specific dates): ___________________________________

Total fee $: ________________________________________________

How fee is determined: Fixed: _____ Milestone: ______ Hourly Rate: _________ Other: _______________________________________________

(Rate)

(Describe Method)

Are you a citizen of the United States? ____ (yes or no). If the answer is “NO”, what visa type are you traveling on? _______________

Note: If you are not a U.S. Citizen or do not have Permanent Residency you need to complete a GLACIER record,

contact Accounts Payable @ (585)__ -_____.

Do you have a relative employed at the University? ___ (yes or no). If “YES” please provide name and department: ____________________________

Section I – Relationship with the University

Yes

No

A. Do you currently work for the University as an employee?

B.

Has the University extended you an offer of employment?

C.

Have you worked as an employee of the University (i.e., received wages) during the 12 months prior to the date of this contract?

If the answer is “NO” to all questions, proceed to Section II.

If the answer is “YES” to any of the questions, the individual should be classified as an employee and paid via payroll.

Section II – Classification Guidelines (Complete only one, A, B or C, depending on the services you will provide)

A. Guest Speaker/Continuing Education Instructor

Yes

No

1.

Will you teach a course from which students will receive credit toward a degree?

If the answer is “Yes”, treat the individual as an employee. If “No”, proceed

2.

Will the University provide you course materials and tools?

3.

Will the University reimburse you for course related expenses?

If the answer to questions 2 and 3 is “Yes”, treat the individual as an employee. If the answer to either is “No”, proceed

4.

Have you been invited, as a guest speaker, to lecture in a seminar, colloquium, class, etc?

5.

Have you been engaged by the University fewer than 3 times in the past 12 months?

If the answer to questions 4 and 5 is “Yes”, treat the individual as an independent contractor.

If the answer to either question is “No”, proceed to question 6.

6.

Have you provided the same or similar services to other unrelated entities in the last 12 months?

7.

Will the department provide specific instructions regarding performance of the required work rather than relying on

your expertise?

Regardless of whether question 6 is answered “Yes” or “No”, if the answer to question 7 is “Yes”, then the individual will be treated as

an employee.

B.

Researcher

Yes

No

1.

Will you perform research under the supervision of a University professor or employee?

If the answer to question 1 is “Yes”, treat the individual as an employee.

2.

Will you serve in an advisory or consulting capacity with a University Professor or employee?

3.

Have you provided the same or similar services to other unrelated entities in the last 12 months?

4.

Will your period of service be completed within a finite time frame?

If the answer to questions 2, 3, and 4 is “Yes”, treat the individual as an Independent Contractor, otherwise treat the individual as an

employee.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3