C

C

A

C

C

A

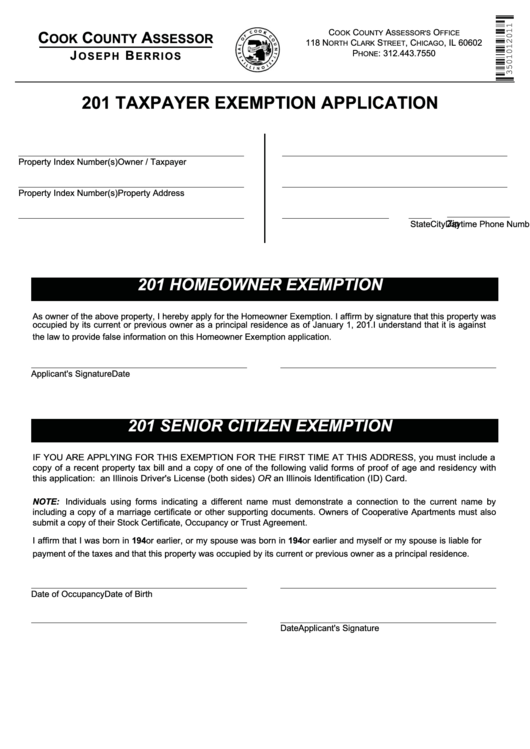

O

OOK

OUNTY

SSESSOR'S

FFICE

OOK

OUNTY

SSESSOR

118 N

C

S

, C

, IL 60602

ORTH

LARK

TREET

HICAGO

J

B

O S E P H

E R R I O S

P

: 312.443.7550

HONE

201 TAXPAYER EXEMPTION APPLICATION

Property Index Number(s)

Owner / Taxpayer

Property Index Number(s)

Property Address

Zip

Daytime Phone Number

City

State

201 HOMEOWNER EXEMPTION

As owner of the above property, I hereby apply for the Homeowner Exemption. I affirm by signature that this property was

occupied by its current or previous owner as a principal residence as of January 1, 201 . I understand that it is against

the law to provide false information on this Homeowner Exemption application.

Applicant's Signature

Date

201 SENIOR CITIZEN EXEMPTION

IF YOU ARE APPLYING FOR THIS EXEMPTION FOR THE FIRST TIME AT THIS ADDRESS, you must include a

copy of a recent property tax bill and a copy of one of the following valid forms of proof of age and residency with

this application: an Illinois Driver's License (both sides) OR an Illinois Identification (ID) Card.

NOTE: Individuals using forms indicating a different name must demonstrate a connection to the current name by

including a copy of a marriage certificate or other supporting documents. Owners of Cooperative Apartments must also

submit a copy of their Stock Certificate, Occupancy or Trust Agreement.

I affirm that I was born in 194 or earlier, or my spouse was born in 194 or earlier and myself or my spouse is liable for

payment of the taxes and that this property was occupied by its current or previous owner as a principal residence.

Date of Occupancy

Date of Birth

Applicant's Signature

Date

1

1