Property Tax Exemption Application Form - Cbj Assessor'S Office - 2003

ADVERTISEMENT

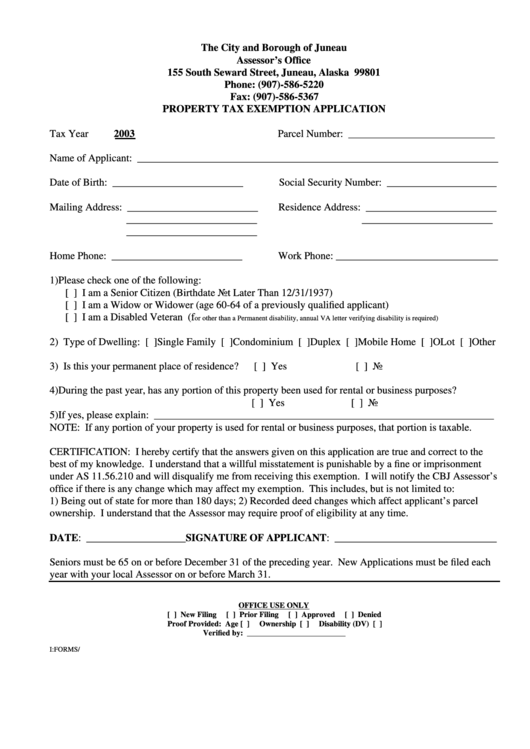

The City and Borough of Juneau

Assessor’s Office

155 South Seward Street, Juneau, Alaska 99801

Phone: (907)-586-5220

Fax: (907)-586-5367

PROPERTY TAX EXEMPTION APPLICATION

Tax Year

2003

Parcel Number: ____________________________

Name of Applicant: _____________________________________________________________________

Date of Birth: _________________________

Social Security Number: _____________________

Mailing Address: _________________________

Residence Address: _________________________

_________________________

_________________________

_________________________

Home Phone: _________________________

Work Phone: _______________________________

1) Please check one of the following:

[ ] I am a Senior Citizen (Birthdate Not Later Than 12/31/1937)

[ ] I am a Widow or Widower (age 60-64 of a previously qualified applicant)

[ ] I am a Disabled Veteran (f

or other than a Permanent disability, annual VA letter verifying disability is required)

2) Type of Dwelling: [ ]Single Family [ ]Condominium [ ]Duplex [ ]Mobile Home [ ]OLot [ ]Other

3) Is this your permanent place of residence?

[ ] Yes

[ ] No

4) During the past year, has any portion of this property been used for rental or business purposes?

[ ] Yes

[ ] No

5) If yes, please explain: _________________________________________________________________

NOTE: If any portion of your property is used for rental or business purposes, that portion is taxable.

CERTIFICATION: I hereby certify that the answers given on this application are true and correct to the

best of my knowledge. I understand that a willful misstatement is punishable by a fine or imprisonment

under AS 11.56.210 and will disqualify me from receiving this exemption. I will notify the CBJ Assessor’s

office if there is any change which may affect my exemption. This includes, but is not limited to:

1) Being out of state for more than 180 days; 2) Recorded deed changes which affect applicant’s parcel

ownership. I understand that the Assessor may require proof of eligibility at any time.

DATE: ___________________SIGNATURE OF APPLICANT: _______________________________

Seniors must be 65 on or before December 31 of the preceding year. New Applications must be filed each

year with your local Assessor on or before March 31.

OFFICE USE ONLY

[ ] New Filing

[ ] Prior Filing

[ ] Approved

[ ] Denied

Proof Provided: Age [ ]

Ownership [ ]

Disability (DV) [ ]

Verified by: _________________________

I:FORMS/SeniorExemptionFormNew2003.doc

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1