Form 1099-R Explanation Of Boxes

ADVERTISEMENT

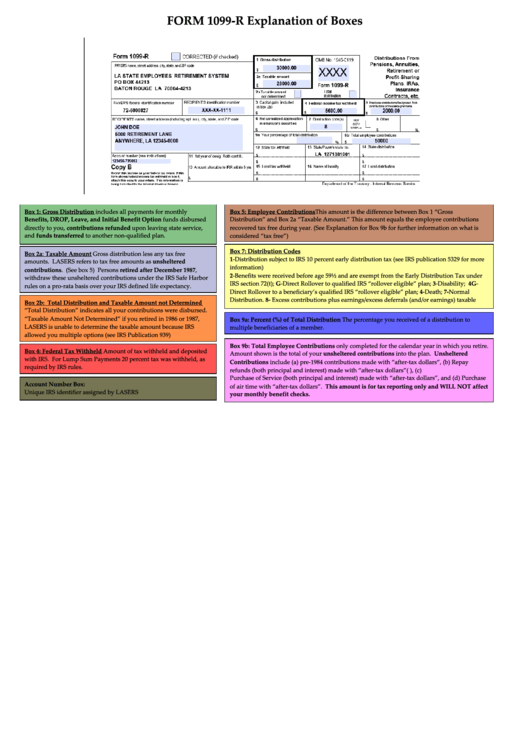

FORM 1099-R Explanation of Boxes

Box 1: Gross Distribution includes all payments for monthly

Box 5: Employee Contributions This amount is the difference between Box 1 “Gross

Benefits, DROP, Leave, and Initial Benefit Option funds disbursed

Distribution” and Box 2a “Taxable Amount.” This amount equals the employee contributions

directly to you, contributions refunded upon leaving state service,

recovered tax free during year. (See Explanation for Box 9b for further information on what is

and funds transferred to another non-qualified plan.

considered “tax free”)

Box 7: Distribution Codes

Box 2a: Taxable Amount Gross distribution less any tax free

1-Distribution subject to IRS 10 percent early distribution tax (see IRS publication 5329 for more

amounts. LASERS refers to tax free amounts as unsheltered

information)

contributions. (See box 5) Persons retired after December 1987,

2-Benefits were received before age 59½ and are exempt from the Early Distribution Tax under

withdraw these unsheltered contributions under the IRS Safe Harbor

IRS section 72(t); G-Direct Rollover to qualified IRS “rollover eligible” plan; 3-Disability; 4G-

rules on a pro-rata basis over your IRS defined life expectancy.

Direct Rollover to a beneficiary’s qualified IRS “rollover eligible” plan; 4-Death; 7-Normal

Distribution. 8- Excess contributions plus earnings/excess deferrals (and/or earnings) taxable

Box 2b: Total Distribution and Taxable Amount not Determined

“Total Distribution” indicates all your contributions were disbursed.

“Taxable Amount Not Determined” if you retired in 1986 or 1987,

Box 9a: Percent (%) of Total Distribution The percentage you received of a distribution to

LASERS is unable to determine the taxable amount because IRS

multiple beneficiaries of a member.

allowed you multiple options (see IRS Publication 939)

Box 9b: Total Employee Contributions only completed for the calendar year in which you retire.

Box 4: Federal Tax Withheld Amount of tax withheld and deposited

Amount shown is the total of your unsheltered contributions into the plan. Unsheltered

with IRS. For Lump Sum Payments 20 percent tax was withheld, as

Contributions include (a) pre-1984 contributions made with “after-tax dollars”, (b) Repay

required by IRS rules.

refunds (both principal and interest) made with “after-tax dollars”(i.e. personal checks), (c)

Purchase of Service (both principal and interest) made with “after-tax dollars”, and (d) Purchase

Account Number Box:

of air time with “after-tax dollars”. This amount is for tax reporting only and WILL NOT affect

Unique IRS identifier assigned by LASERS

your monthly benefit checks.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1