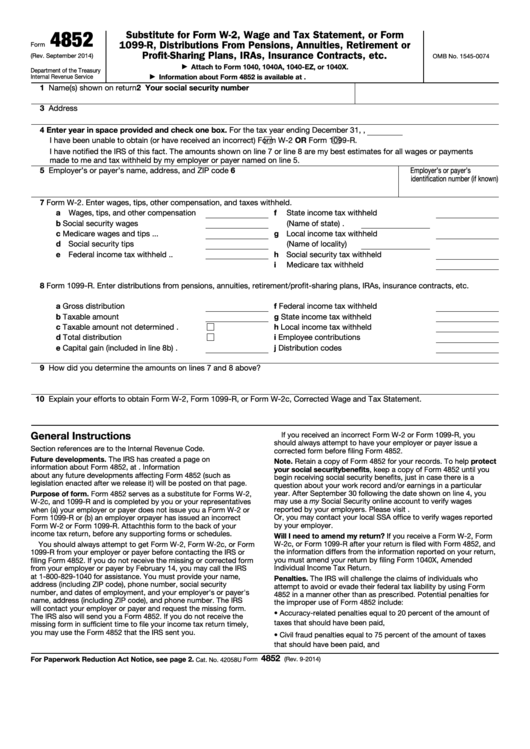

4852

Substitute for Form W-2, Wage and Tax Statement, or Form

1099-R, Distributions From Pensions, Annuities, Retirement or

Form

Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

(Rev. September 2014)

OMB No. 1545-0074

Attach to Form 1040, 1040A, 1040-EZ, or 1040X.

▶

Department of the Treasury

Information about Form 4852 is available at

Internal Revenue Service

▶

1 Name(s) shown on return

2 Your social security number

3 Address

4 Enter year in space provided and check one box. For the tax year ending December 31,

,

Form W-2 OR

I have been unable to obtain (or have received an incorrect)

Form 1099-R.

I have notified the IRS of this fact. The amounts shown on line 7 or line 8 are my best estimates for all wages or payments

made to me and tax withheld by my employer or payer named on line 5.

5 Employer’s or payer’s name, address, and ZIP code

6 Employer’s or payer’s

identification number (if known)

7

Form W-2. Enter wages, tips, other compensation, and taxes withheld.

a Wages, tips, and other compensation

f

State income tax withheld .

.

.

.

.

b Social security wages

.

.

.

.

(Name of state) .

c Medicare wages and tips

.

.

.

g Local income tax withheld .

.

.

.

.

d Social security tips

.

.

.

.

.

(Name of locality)

e Federal income tax withheld

h Social security tax withheld .

.

.

.

.

.

.

i

Medicare tax withheld

.

.

.

.

.

.

8

Form 1099-R. Enter distributions from pensions, annuities, retirement/profit-sharing plans, IRAs, insurance contracts, etc.

a Gross distribution .

f

.

.

.

.

.

Federal income tax withheld

.

.

.

.

b Taxable amount

.

.

.

.

.

.

g State income tax withheld .

.

.

.

.

c Taxable amount not determined .

h Local income tax withheld .

.

.

.

.

d Total distribution .

.

.

.

.

.

i

Employee contributions .

.

.

.

.

.

e Capital gain (included in line 8b) .

j

Distribution codes .

.

.

.

.

.

.

.

9 How did you determine the amounts on lines 7 and 8 above?

10 Explain your efforts to obtain Form W-2, Form 1099-R, or Form W-2c, Corrected Wage and Tax Statement.

General Instructions

If you received an incorrect Form W-2 or Form 1099-R, you

should always attempt to have your employer or payer issue a

Section references are to the Internal Revenue Code.

corrected form before filing Form 4852.

Future developments. The IRS has created a page on IRS.gov for

Note. Retain a copy of Form 4852 for your records. To help protect

information about Form 4852, at Information

your social security benefits, keep a copy of Form 4852 until you

about any future developments affecting Form 4852 (such as

begin receiving social security benefits, just in case there is a

legislation enacted after we release it) will be posted on that page.

question about your work record and/or earnings in a particular

Purpose of form. Form 4852 serves as a substitute for Forms W-2,

year. After September 30 following the date shown on line 4, you

may use a my Social Security online account to verify wages

W-2c, and 1099-R and is completed by you or your representatives

reported by your employers. Please visit

when (a) your employer or payer does not issue you a Form W-2 or

Or, you may contact your local SSA office to verify wages reported

Form 1099-R or (b) an employer or payer has issued an incorrect

by your employer.

Form W-2 or Form 1099-R. Attach this form to the back of your

income tax return, before any supporting forms or schedules.

Will I need to amend my return? If you receive a Form W-2, Form

W-2c, or Form 1099-R after your return is filed with Form 4852, and

You should always attempt to get Form W-2, Form W-2c, or Form

1099-R from your employer or payer before contacting the IRS or

the information differs from the information reported on your return,

you must amend your return by filing Form 1040X, Amended U.S.

filing Form 4852. If you do not receive the missing or corrected form

Individual Income Tax Return.

from your employer or payer by February 14, you may call the IRS

at 1-800-829-1040 for assistance. You must provide your name,

Penalties. The IRS will challenge the claims of individuals who

address (including ZIP code), phone number, social security

attempt to avoid or evade their federal tax liability by using Form

number, and dates of employment, and your employer's or payer's

4852 in a manner other than as prescribed. Potential penalties for

name, address (including ZIP code), and phone number. The IRS

the improper use of Form 4852 include:

will contact your employer or payer and request the missing form.

• Accuracy-related penalties equal to 20 percent of the amount of

The IRS also will send you a Form 4852. If you do not receive the

taxes that should have been paid,

missing form in sufficient time to file your income tax return timely,

you may use the Form 4852 that the IRS sent you.

• Civil fraud penalties equal to 75 percent of the amount of taxes

that should have been paid, and

4852

For Paperwork Reduction Act Notice, see page 2.

Form

(Rev. 9-2014)

Cat. No. 42058U

1

1 2

2