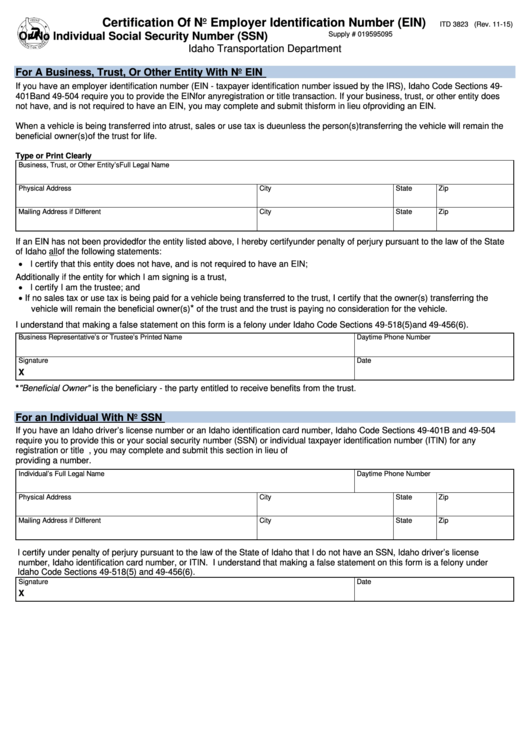

Certification Of No Employer Identification Number (EIN)

ITD 3823 (Rev. 11-15)

Supply # 019595095

Or No Individual Social Security Number (SSN)

Idaho Transportation Department

For A Business, Trust, Or Other Entity With No EIN

If you have an employer identification number (EIN - taxpayer identification number issued by the IRS), Idaho Code Sections 49-

401B and 49-504 require you to provide the EIN for any registration or title transaction. If your business, trust, or other entity does

not have, and is not required to have an EIN, you may complete and submit this form in lieu of providing an EIN.

When a vehicle is being transferred into a trust, sales or use tax is due unless the person(s) transferring the vehicle will remain the

beneficial owner(s) of the trust for life.

Type or Print Clearly

Business, Trust, or Other Entity’s Full Legal Name

Physical Address

City

State

Zip

Mailing Address if Different

City

State

Zip

If an EIN has not been provided for the entity listed above, I hereby certify under penalty of perjury pursuant to the law of the State

of Idaho all of the following statements:

• I certify that this entity does not have, and is not required to have an EIN;

Additionally if the entity for which I am signing is a trust,

• I certify I am the trustee; and

• If no sales tax or use tax is being paid for a vehicle being transferred to the trust, I certify that the owner(s) transferring the

*

vehicle will remain the beneficial owner(s)

of the trust and the trust is paying no consideration for the vehicle.

I understand that making a false statement on this form is a felony under Idaho Code Sections 49-518(5) and 49-456(6).

Business Representative’s or Trustee’s Printed Name

Daytime Phone Number

Signature

Date

X

*"Beneficial Owner" is the beneficiary - the party entitled to receive benefits from the trust.

For an Individual With No SSN

If you have an Idaho driver’s license number or an Idaho identification card number, Idaho Code Sections 49-401B and 49-504

require you to provide this or your social security number (SSN) or individual taxpayer identification number (ITIN) for any

registration or title transaction. If you do not have any of these numbers, you may complete and submit this section in lieu of

providing a number.

Individual’s Full Legal Name

Daytime Phone Number

Physical Address

City

State

Zip

Mailing Address if Different

City

State

Zip

I certify under penalty of perjury pursuant to the law of the State of Idaho that I do not have an SSN, Idaho driver’s license

number, Idaho identification card number, or ITIN. I understand that making a false statement on this form is a felony under

Idaho Code Sections 49-518(5) and 49-456(6).

Signature

Date

X

1

1