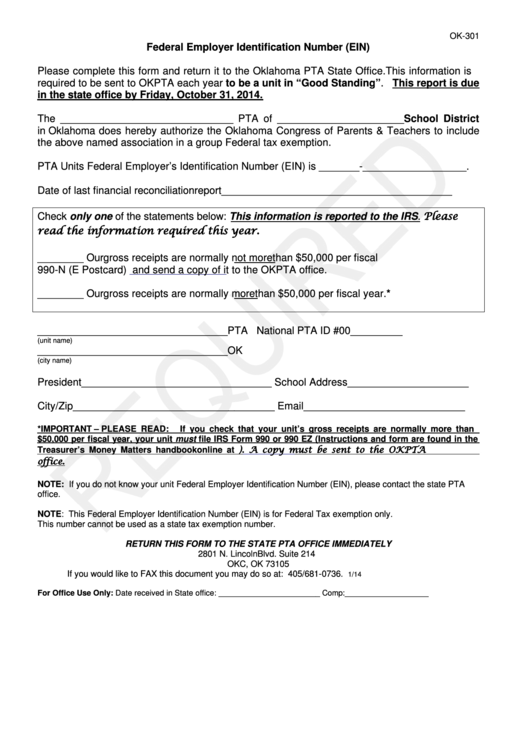

OK-301

Federal Employer Identification Number (EIN)

Please complete this form and return it to the Oklahoma PTA State Office. This information is

required to be sent to OKPTA each year to be a unit in “Good Standing”. This report is due

in the state office by Friday, October 31, 2014.

The ______________________________ PTA of ______________________School District

in Oklahoma does hereby authorize the Oklahoma Congress of Parents & Teachers to include

the above named association in a group Federal tax exemption.

PTA Units Federal Employer’s Identification Number (EIN) is _______-__________________.

Date of last financial reconciliation report________________________________________

Check only one of the statements below: This information is reported to the IRS. Please

read the information required this year.

________ Our gross receipts are normally not more than $50,000 per fiscal year. You must file

990-N (E Postcard)

and send a copy of it to the OKPTA office.

________ Our gross receipts are normally more than $50,000 per fiscal year.*

_________________________________PTA

National PTA ID #00_________

(unit name)

_________________________________OK

(city name)

President_________________________________ School Address_____________________

City/Zip___________________________________ Email____________________________

*IMPORTANT – PLEASE READ:

If you check that your unit’s gross receipts are normally more than

$50,000 per fiscal year, your unit must file IRS Form 990 or 990 EZ (Instructions and form are found in the

Treasurer’s Money Matters handbook online at ). A copy must be sent to the OKPTA

office.

NOTE: If you do not know your unit Federal Employer Identification Number (EIN), please contact the state PTA

office.

NOTE: This Federal Employer Identification Number (EIN) is for Federal Tax exemption only.

This number cannot be used as a state tax exemption number.

RETURN THIS FORM TO THE STATE PTA OFFICE IMMEDIATELY

2801 N. Lincoln Blvd. Suite 214

OKC, OK 73105

If you would like to FAX this document you may do so at: 405/681-0736.

1/14

For Office Use Only: Date received in State office: _______________________ Comp:___________________

1

1