Print and Reset Form

Reset Form

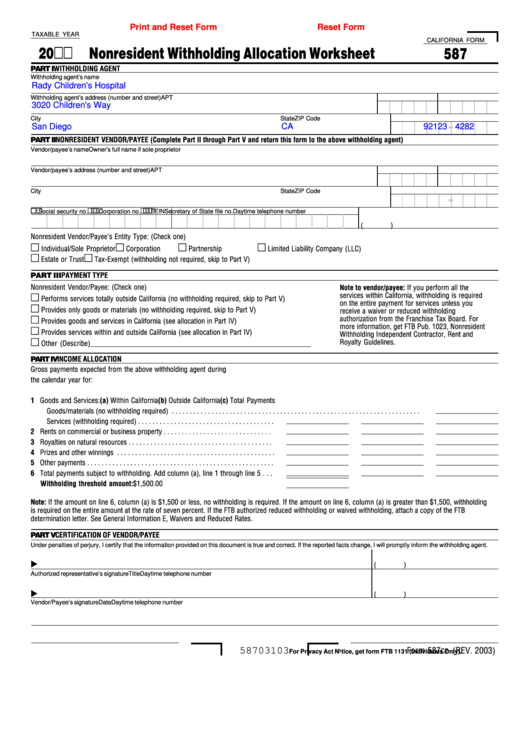

TAXABLE YEAR

CALIFORNIA FORM

20

Nonresident Withholding Allocation Worksheet

587

WITHHOLDING AGENT

PART I

Withholding agent’s name

Rady Children's Hospital

Withholding agent’s address (number and street)

APT no.

PMB no.

3020 Children's Way

City

State

ZIP Code

-

CA

San Diego

92123 4282

NONRESIDENT VENDOR/PAYEE (Complete Part II through Part V and return this form to the above withholding agent)

PART II

Vendor/payee’s name

Owner’s full name if sole proprietor

Vendor/payee’s address (number and street)

APT no.

PMB no.

City

State

ZIP Code

-

Social security no.

Corporation no.

FEIN

Secretary of State file no.

Daytime telephone number

(

)

Nonresident Vendor/Payee’s Entity Type: (Check one)

Individual/Sole Proprietor

Corporation

Partnership

Limited Liability Company (LLC)

Estate or Trust

Tax-Exempt (withholding not required, skip to Part V)

PART III PAYMENT TYPE

Nonresident Vendor/Payee: (Check one)

Note to vendor/payee: If you perform all the

services within California, withholding is required

Performs services totally outside California (no withholding required, skip to Part V)

on the entire payment for services unless you

Provides only goods or materials (no withholding required, skip to Part V)

receive a waiver or reduced withholding

authorization from the Franchise Tax Board. For

Provides goods and services in California (see allocation in Part IV)

more information, get FTB Pub. 1023, Nonresident

Provides services within and outside California (see allocation in Part IV)

Withholding Independent Contractor, Rent and

Royalty Guidelines.

Other (Describe)____________________________________________________________

PART IV INCOME ALLOCATION

Gross payments expected from the above withholding agent during

the calendar year for:

1 Goods and Services:

(a) Within California

(b) Outside California

(c) Total Payments

Goods/materials (no withholding required) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Services (withholding required) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Rents on commercial or business property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Royalties on natural resources . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Prizes and other winnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Other payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Total payments subject to withholding. Add column (a), line 1 through line 5 . . .

Withholding threshold amount:

$1,500.00

Note: If the amount on line 6, column (a) is $1,500 or less, no withholding is required. If the amount on line 6, column (a) is greater than $1,500, withholding

is required on the entire amount at the rate of seven percent. If the FTB authorized reduced withholding or waived withholding, attach a copy of the FTB

determination letter. See General Information E, Waivers and Reduced Rates.

PART V

CERTIFICATION OF VENDOR/PAYEE

Under penalties of perjury, I certify that the information provided on this document is true and correct. If the reported facts change, I will promptly inform the withholding agent.

(

)

Authorized representative’s signature

Title

Daytime telephone number

(

)

Vendor/Payee’s signature

Date

Daytime telephone number

58703103

Form 587

(REV. 2003)

C2

For Privacy Act Notice, get form FTB 1131 (Individuals Only).

1

1 2

2 3

3