• An entity that is exempt from tax under

H To get Publications, Forms,

either California or federal law such as a

and Information Unrelated to

church, pension, or profit-sharing plan;

Nonresident Withholding

• An insurance company, IRA; or

• A federal, state, or local government

By Automated Phone Service: Use this

agency.

service to check the status of your refund,

order California and federal tax forms, obtain

Tax-exempt vendors/payees do not need to

payment and balance due information, and

complete Part III and Part IV, but must

hear recorded answers to general questions.

complete Part V.

This service is available 24 hours a day, 7

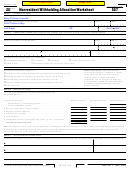

Part III – Payment Type

days a week, in English and Spanish.

The nonresident vendor/payee must check the

From within the

box that identifies the type of payment being

United States . . . . . . . . . . . (800) 338-0505

received.

From outside the

No withholding is required when vendors/

United States . . . . . . . . . . . (916) 845-6600

payees are residents, qualified corporations,

(not toll-free)

or have a permanent place of business in

Follow the recorded instructions. Have paper

California.

and pencil handy to take notes.

Part IV – Income Allocation

By Mail: Please allow two weeks to receive

your order. If you live outside of California,

Use Part IV to identify payments that are

please allow three weeks to receive your

subject to withholding. Only payments

order. Write to:

sourced within California are subject to

withholding. Services performed in California

TAX FORMS REQUEST UNIT

are sourced in California. In the case of

FRANCHISE TAX BOARD

payments for services performed when part of

PO BOX 307

the services are performed outside California,

RANCHO CORDOVA CA 95741-0307

enter the amount paid for performing services

In Person: Many libraries, post offices, and

within California in column (a). Enter the

banks provide free California personal income

amount paid for performing services while

tax booklets during the filing season. Most

outside California in column (b). Enter the

libraries and some quick print businesses

total amount paid for services in column (c).

have forms and schedules to photocopy (a

If the vendor/payee’s trade, business, or

nominal fee may apply).

profession carried on in California is an

Note: Employees at libraries, post offices,

integral part of a unitary business carried on

banks, and quick print businesses cannot

within and outside California, the amounts

provide tax information or assistance.

included on line 1 through line 5 should be

Assistance for persons with disabilities

computed by applying the vendor/payee’s

We comply with the Americans with Disabili-

California apportionment percentage (deter-

ties Act. Persons with hearing or speech

mined in accordance with the provisions of

impairments, please call:

the Uniform Division of Income for Tax

Purposes Act) to the payment amounts. For

TTY/TDD . . . . . . . . . . . . . . . . (800) 822-6268

more information on apportionment, refer to

Asistencia para personas discapacitadas.

California Schedule R, Apportionment and

Nosotros estamos en conformidad con el Acta

Allocation of Income.

de Americanos Discapacitados. Personas con

Withholding agent. If the amount on line 6 is

problemas auditivos pueden llamar al TTY/

greater than $1,500, the withholding agent

TDD (800) 822-6268.

must withhold on all payments made to the

vendor/payee until the entire amount on line 6

Specific Instructions

has been withheld upon. If circumstances

change during the year (such as the total

Private Mailbox (PMB) Number

amount of payments), which would change

If you lease a private mailbox (PMB) from a

the amount on line 6, the vendor/payee must

private business rather than a PO box from

submit a new Form 587 to the withholding

the United States Postal Service, include the

agent reflecting those changes. The withhold-

box number in the field labeled “PMB no.” in

ing agent should evaluate the need for a new

the address area.

Form 587 when a change in facts occurs.

Part I – Withholding Agent

If a reduced rate was authorized by the FTB,

compute the withholding required by applying

The withholding agent must complete Part I

the authorized rate to the amount on line 6.

before giving Form 587 to the vendor/payee.

Part V – Certification of Vendor/Payee

Part II – Nonresident Vendor/Payee

Enter your name, title, and daytime telephone

The vendor/payee must complete all informa-

number. Sign and date the form and return it

tion in Part II including the FEIN or social

to the withholding agent.

security number and vendor/payee’s entity

type. No withholding is required if the vendor/

payee is a tax-exempt entity. Check the tax-

exempt box if the vendor/payee is:

Page 2 Form 587 Instructions

(REV. 2003)

1

1 2

2 3

3