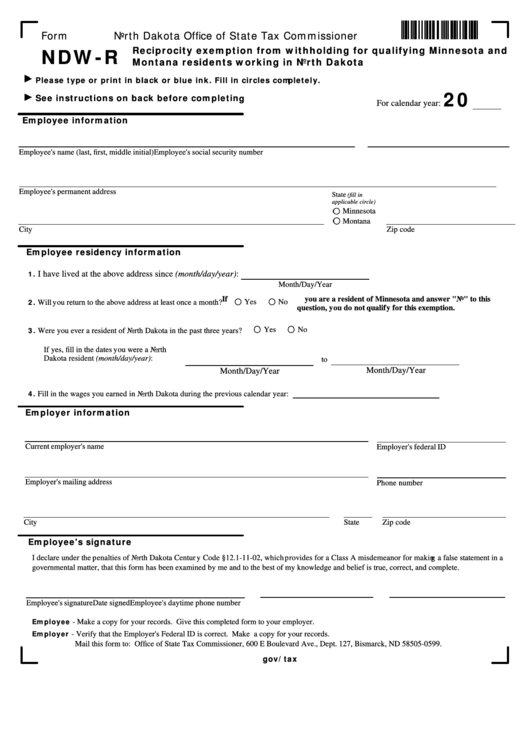

Form Ndw-R Reciprocity Exemption From Withholding For Qualifying Minnesota And Montana Residents Working In North Dakota

ADVERTISEMENT

Form

North Dakota Office of State Tax Commissioner

Reciprocity exemption from withholding for qualifying Minnesota and

NDW-R

Montana residents working in North Dakota

Please type or print in black or blue ink. Fill in circles completely.

20

See instructions on back before completing

For calendar year:

Employee information

Employee's name (last, first, middle initial)

Employee's social security number

Employee's permanent address

State

(fill in

applicable circle)

Minnesota

Montana

City

Zip code

Employee residency information

1.

I have lived at the above address since (month/day/year):

Month/Day/Year

If you are a resident of Minnesota and answer "No" to this

2.

Yes

No

Will you return to the above address at least once a month?

question, you do not qualify for this exemption.

3.

Yes

No

Were you ever a resident of North Dakota in the past three years?

If yes, fill in the dates you were a North

Dakota resident (month/day/year):

to

Month/Day/Year

Month/Day/Year

4.

Fill in the wages you earned in North Dakota during the previous calendar year:

Employer information

Current employer's name

Employer's federal ID

Employer's mailing address

Phone number

City

State

Zip code

Employee's signature

I declare under the penalties of North Dakota Century Code §12.1-11-02, which provides for a Class A misdemeanor for making a false statement in a

governmental matter, that this form has been examined by me and to the best of my knowledge and belief is true, correct, and complete.

Date signed

Employee's daytime phone number

Employee's signature

Employee

- Make a copy for your records. Give this completed form to your employer.

Employer

- Verify that the Employer's Federal ID is correct. Make a copy for your records.

Mail this form to: Office of State Tax Commissioner, 600 E Boulevard Ave., Dept. 127, Bismarck, ND 58505-0599.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2