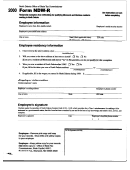

Form Ndw-R Reciprocity Exemption From Withholding For Qualifying Minnesota And Montana Residents Working In North Dakota Page 2

ADVERTISEMENT

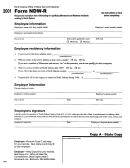

Form NDW-R instructions

Instructions for

Instructions for

Fill out the form completely

employee

employer

If you do not fi ll in every item on this

form, your employer must withhold

North Dakota has income tax reciprocity

North Dakota income tax from your

Employees who reside in Minnesota or

agreements with Minnesota and Montana.

wages. Sign and date the form. Your

Montana who ask you not to withhold

If you are a resident of one of these

North Dakota income tax from their

phone number is not required, but we ask

states, the agreements provide that

for it so we can contact you if we have

wages must complete this form and give

you do not have to pay North Dakota

questions.

it to you by February 28 or within 30

income tax on wages you earn for work

days after they begin working for you

in North Dakota. If you are a resident

or change their residence. Employees

Your employer will be able to provide

of Minnesota, this applies only if you

you with the correct federal ID number if

who live in other states, including North

return to your permanent residence in

Dakota, cannot use this form.

you do not have this information.

Minnesota at least once a month.

Note: The wages you earn for work in

Make a copy of this form for your records

For forms received by February 28, mail

North Dakota are subject to income tax

and give the original to your employer.

the original on or before March 31 to:

in your state of residence.

Offi ce of State Tax Commissioner

600 E. Boulevard Ave., Dept. 127

Use of information

If you do not want North Dakota

Bismarck, ND 58505-0599

income tax withheld from your wages,

All information on this form is

you must complete this form and give

For new employees or employees who

confi dential by state law. It may only

it to your employer by February 28 of

change their permanent home address,

be given to your state of residence, the

the calendar year for which you want

mail the original to the above address

Internal Revenue Service, other states

it to apply, or within 30 days after you

within 30 days of receipt.

that guarantee the same confi dentiality,

begin working or change your permanent

and to other state agencies as provided by

residence. You must complete a new

Please verify your federal ID number is

law. The information may be compared

form and give it to your employer each

correct. Make a copy of the completed

with other information you furnished to

year to continue the exemption from

form for your records.

the Offi ce of State Tax Commissioner.

withholding.

If an employee does not fi ll in every item

Your name, address and social security

If you do not complete this form and give

on this form and the employee does not

number are required for identifi cation.

it to your employer as explained above,

correct the omission, you must withhold

Your address is also required to verify

your employer must withhold North

North Dakota income tax from the

your state of residence. Your employer’s

Dakota income tax from your wages.

employee’s wages.

name, address, federal ID number and

phone number are required in case we

If North Dakota income tax was

An employee must complete this form

have to contact your employer regarding

already withheld from your wages, you

and give it to you each year to continue

withholding income tax from your

must complete and fi le a North Dakota

the exemption from withholding.

wages. If you do not complete any of this

income tax return at the end of the year to

information, your employer is required to

obtain a refund.

withhold North Dakota income tax from

your wages.

Need forms or assistance?

Visit our Web site

You can download tax forms, ask us a question or send us a message via e-mail, and fi nd other useful information on our Web site

at:

Call us

For additional NDW-R forms, you may call (701) 328-1243.

For questions about this form or about income tax withholding, please call (701) 328-1248.

The speech or hearing impaired may call us through Relay North Dakota at 1-800-366-6888.

Write to us

You may also write to: Offi ce of State Tax Commissioner, 600 E. Boulevard Ave., Dept. 127, Bismarck, ND 58505-0599.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2