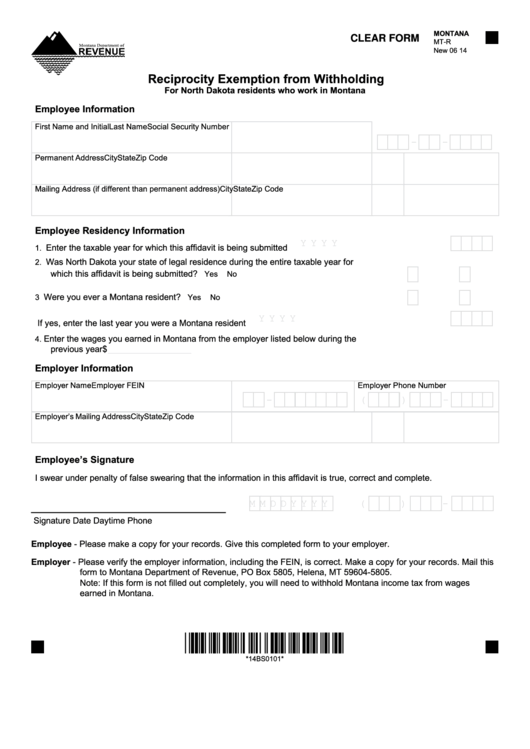

MONTANA

CLEAR FORM

MT-R

New 06 14

Reciprocity Exemption from Withholding

For North Dakota residents who work in Montana

Employee Information

First Name and Initial

Last Name

Social Security Number

XXXXXXXXXXXX

X

XXXXXXXXXXXXXXXXXXXX

XXX XX XXXX

-

-

Permanent Address

City

State

Zip Code

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXX

XX

XXXXX XXXX

Mailing Address (if different than permanent address)

City

State

Zip Code

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXX

XX

XXXXX XXXX

Employee Residency Information

Y Y Y Y

YYYY

Enter the taxable year for which this affidavit is being submitted ............................................................

1.

Was North Dakota your state of legal residence during the entire taxable year for

2.

X

X

which this affidavit is being submitted?

........................................................................................

Yes

No

X

X

Were you ever a Montana resident?

3

.............................................................................................

Yes

No

YYYY

Y Y Y Y

If yes, enter the last year you were a Montana resident ..........................................................................

Enter the wages you earned in Montana from the employer listed below during the

4.

XXXXXXXXXXXX00

previous year ........................................................................................................................... $

___________________

Employer Information

Employer Name

Employer FEIN

Employer Phone Number

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XX XXXXXXX

XXX XXX XXXX

-

(

)

-

Employer’s Mailing Address

City

State

Zip Code

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXX

XX

XXXXX XXXX

Employee’s Signature

I swear under penalty of false swearing that the information in this affidavit is true, correct and complete.

MMDDYYYY

XXX XXX XXXX

M M D D Y Y Y Y

(

)

-

_________________________________________

Signature

Date

Daytime Phone

Employee - Please make a copy for your records. Give this completed form to your employer.

Employer - Please verify the employer information, including the FEIN, is correct. Make a copy for your records. Mail this

form to Montana Department of Revenue, PO Box 5805, Helena, MT 59604-5805.

Note: If this form is not filled out completely, you will need to withhold Montana income tax from wages

earned in Montana.

*14BS0101*

*14BS0101*

1

1 2

2