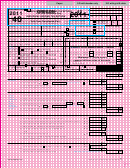

North Dakota Office of State Tax Commissioner

2011 Form ND-1, page 2

19.

North Dakota taxable income

19

Enter your

from line 18 of page 1

Tax calculation

20. Tax -

full-year resident,

If a

enter amount from Tax Table on page 20 of instructions; however,

OR

if you have farm income, see page 13 of instructions;

full-year nonresident

part-year resident,

(SB) 20

If a

or

enter amount from Schedule ND-1NR, line 21

Credits

21.

Credit for income tax paid to another state

(Attach Schedule ND-1CR)

(SD) 21

22.

Marriage penalty credit for joint filers

(AC) 22

(From worksheet on page 14 of instructions)

23.

Carryover of unused 2007 or 2008 residential/agricultural

(AM) 23

property tax credit

24.

Carryover of unused 2007 or 2008 commercial property

(AN) 24

tax credit

25.

(AE) 25

Total other credits (Attach Schedule ND-1TC)

26

26.

Total credits. Add lines 21 through 25

27. Net tax liability.

If less than zero, enter 0

(SE) 27

Subtract line 26 from line 20.

Tax paid

28.

(SF) 28

North Dakota withholding (Attach W-2s, 1099s, and/or N.D. K-1s)

29.

Estimated tax paid on 2011 Forms ND-1ES and ND-1EXT

(S&) 29

plus an overpayment, if any, applied from your 2010 return

30.

(AJ) 30

Total payments. Add lines 28 and 29

Refund

31. Overpayment

- If line 30 is MORE than line 27, subtract line 27 from line 30;

(SG) 31

If less than $5.00, enter 0

otherwise, go to line 35.

32.

(SQ) 32

Amount of line 31 that you want applied to your 2012 estimated tax

33.

Enter

Voluntary

Watchable

Trees For ND

(SP)

(SW)

total

33

contribution to:

Wildlife Fund

Program Trust Fund

34. Refund.

If less than $5.00, enter 0

(SR) 34

Subtract lines 32 and 33 from line 31.

direct deposit

a.

your refund,

To

Routing number:

complete items a, b, and c.

b.

Account number:

(See page 15)

c.

Type of account:

Checking

Savings

Tax Due

35. Tax due -

If line 30 is LESS than line 27, subtract line 30 from line 27.

(SZ) 35

If less than $5.00, enter 0

36

36.

(AL)

Enter total

(AK)

Penalty

Interest

37.

Enter

Voluntary

Watchable

Trees For ND

37

(SU)

(SY)

total

contribution to:

Wildlife Fund

Program Trust Fund

38. Balance due.

Add lines 35, 36, 37, and, if applicable, line 39.

ND State Tax Commissioner

38

Pay to:

39.

(SO) 39

Interest on underpaid estimated tax from Schedule ND-1UT

Privacy Act

See inside front cover of booklet.

I declare that this return is correct and complete to the best of my knowledge and belief.

*

-

Your signature

Date

Phone number (land line)

I authorize the ND Office of State Tax Commissioner to

discuss this return with the paid preparer.

Date

Spouse's signature

Cell phone number

This Space Is For Tax Department Use Only

Paid preparer signature

PTIN

Date

Phone no.

Print name of paid preparer

i

Attach copy of 2011

Mail to: State Tax Commissioner, PO Box 5621,

federal income tax return

Bismarck, ND 58506-5621

1

1 2

2