RESET FORM

PRINT FORM

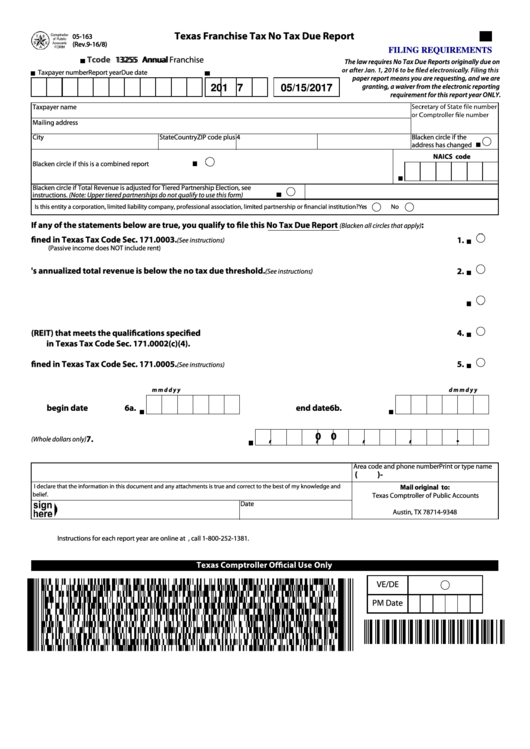

Texas Franchise Tax No Tax Due Report

05-163

05-163

(Rev.9-16/8)

(Rev.9-16/8)

FILING REQUIREMENTS

Tcode

13255 Annual

13255 Annual Franchise

The law requires No Tax Due Reports originally due on

Taxpayer number

Report year

Due date

paper report means you are requesting, and we are

granting, a waiver from the electronic reporting

2 0 1 7

05/15/2017

requirement for this report year ONLY.

Taxpayer name

Mailing address

Blacken circle if the

City

State

Country

ZIP code plus 4

address has changed

NAICS code

Blacken circle if this is a combined report

Blacken circle if Total Revenue is adjusted for Tiered Partnership Election, see

instructions. (Note: Upper tiered partnerships do not qualify to use this form)

Is this entity a corporation, limited liability company, professional association, limited partnership or nancial institution?

Yes

No

If any of the statements below are true, you qualify to le this No Tax Due Report

:

(Blacken all circles that apply)

1. This entity is a passive entity as de ned in Texas Tax Code Sec. 171.0003.

1.

(See instructions)

(Passive income does NOT include rent)

2. This entity's annualized total revenue is below the no tax due threshold.

2.

(See instructions)

3. This entity has zero Texas Gross Receipts.

3.

4. This entity is a Real Estate Investment Trust (REIT) that meets the quali cations speci ed

4.

in Texas Tax Code Sec. 171.0002(c)(4).

5. This entity is a new veteran-owned business as de ned in Texas Tax Code Sec. 171.0005.

5.

(See instructions)

m

m

d

d

y

y

m

m

d

d

y

y

6a. Accounting year

6b. Accounting year

begin date

6a.

end date

6b.

0 0

7. TOTAL REVENUE

7.

(Whole dollars only)

Print or type name

Area code and phone number

(

)

-

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and

Mail original to:

belief.

Texas Comptroller of Public Accounts

Date

P.O. Box 149348

Austin, TX 78714-9348

Instructions for each report year are online at If you have any questions, call 1-800-252-1381.

VE/DE

PM Date

1

1