05-172

(Rev.1-08/2)

PRINT FORM

CLEAR FIELDS

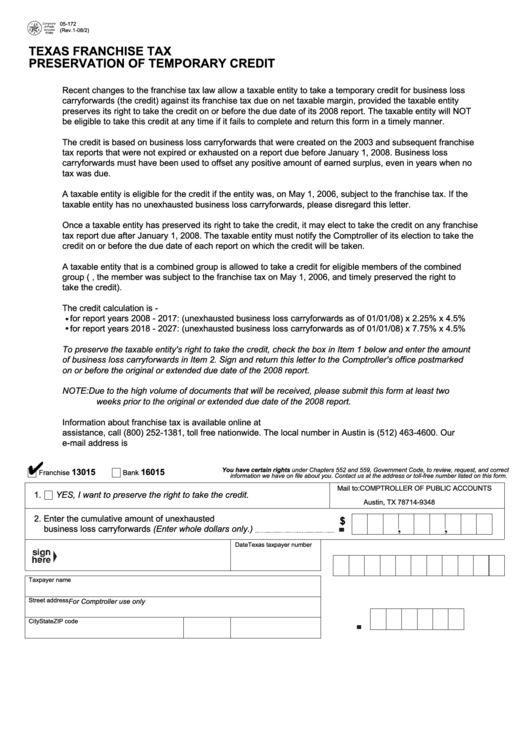

TEXAS FRANCHISE TAX

PRESERVATION OF TEMPORARY CREDIT

Recent changes to the franchise tax law allow a taxable entity to take a temporary credit for business loss

carryforwards (the credit) against its franchise tax due on net taxable margin, provided the taxable entity

preserves its right to take the credit on or before the due date of its 2008 report. The taxable entity will NOT

be eligible to take this credit at any time if it fails to complete and return this form in a timely manner.

The credit is based on business loss carryforwards that were created on the 2003 and subsequent franchise

tax reports that were not expired or exhausted on a report due before January 1, 2008. Business loss

carryforwards must have been used to offset any positive amount of earned surplus, even in years when no

tax was due.

A taxable entity is eligible for the credit if the entity was, on May 1, 2006, subject to the franchise tax. If the

taxable entity has no unexhausted business loss carryforwards, please disregard this letter.

Once a taxable entity has preserved its right to take the credit, it may elect to take the credit on any franchise

tax report due after January 1, 2008. The taxable entity must notify the Comptroller of its election to take the

credit on or before the due date of each report on which the credit will be taken.

A taxable entity that is a combined group is allowed to take a credit for eligible members of the combined

group (i.e., the member was subject to the franchise tax on May 1, 2006, and timely preserved the right to

take the credit).

The credit calculation is -

for report years 2008 - 2017: (unexhausted business loss carryforwards as of 01/01/08) x 2.25% x 4.5%

for report years 2018 - 2027: (unexhausted business loss carryforwards as of 01/01/08) x 7.75% x 4.5%

To preserve the taxable entity's right to take the credit, check the box in Item 1 below and enter the amount

of business loss carryforwards in Item 2. Sign and return this letter to the Comptroller's office postmarked

on or before the original or extended due date of the 2008 report.

NOTE: Due to the high volume of documents that will be received, please submit this form at least two

weeks prior to the original or extended due date of the 2008 report.

Information about franchise tax is available online at For taxpayer

assistance, call (800) 252-1381, toll free nationwide. The local number in Austin is (512) 463-4600. Our

e-mail address is tax.help@cpa.state.tx.us.

You have certain rights under Chapters 552 and 559, Government Code, to review, request, and correct

13015

16015

Franchise

Bank

information we have on file about you. Contact us at the address or toll-free number listed on this form.

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

1.

YES, I want to preserve the right to take the credit.

P.O. Box 149348

Austin, TX 78714-9348

2. Enter the cumulative amount of unexhausted

$

,

,

business loss carryforwards (Enter whole dollars only.)

Date

Texas taxpayer number

Taxpayer name

Street address

For Comptroller use only

City

State

ZIP code

1

1