Power Of Attorney And Declaration Of Representative Page 3

ADVERTISEMENT

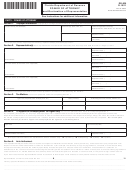

DR-835

R. 10/11

Page 3

POWER OF ATTORNEY INSTRUCTIONS

Purpose of this form

Section 2 – Representative(s)

A Power of Attorney (Form DR-835) signed by the taxpayer and the

Enter the individual name, firm name (if applicable), address,

representative is required by the Florida Department of Revenue

telephone number(s), and fax number of each individual appointed as

in order for the taxpayer’s representative to perform certain acts

attorney-in-fact and representative. If the representatives have the

on behalf of the taxpayer and to receive and inspect confidential

same address, simply write “same” in the appropriate box. If you wish

tax information. You and your representative must complete, sign,

to appoint more than three representatives, you should attach a letter

and return Form DR-835 if you want to grant Power of Attorney

to Form DR-835 listing those additional individuals.

to an attorney, certified public accountant, enrolled agent, former

Section 3 – Tax Matters

Department employee, unemployment tax agent, or any other qualified

Enter the type(s) of tax this Power of Attorney authorization applies to

individual. A Power of Attorney is a legal document authorizing

and the years or periods for which the Power of Attorney is granted.

someone other than yourself to act as your representative.

The word “All” is not specific enough. If your tax situation does not fit

You may use this form for any matters affecting any tax administered

into a tax type or period (for example, a specific administrative appeal,

by the Department of Revenue. This includes both the audit and

audit, or collection matter), describe it in the blank space provided

collection processes. A Power of Attorney will remain in effect until

for “Tax Matters.” The Power of Attorney can be limited to specific

you revoke it. If you provide more than one Power of Attorney with

reporting period(s) that can be stated in year(s), quarter(s), month(s),

respect to a tax and tax period, the Department employee handling

etc., or can be granted for an indefinite period. You must indicate

your case will address notices and correspondence relative to that

the tax types, periods, and/or matters for which you are authorizing

issue to the first person listed on the latest Power of Attorney.

representation by your attorney-in-fact.

A Power of Attorney Form is generally not required, if the

Examples:

representative is, or is accompanied by: a trustee, a receiver, an

Sales and Use Tax

First and second quarter 2008

administrator, an executor of an estate, a corporate officer, or an

Corporate Income Tax

7/1/07 – 6/30/08

authorized employee of the taxpayer.

Communications Services Tax

2006 thru 2008

Photocopies and fax copies of Form DR-835 are usually acceptable.

Insurance Premium Tax

1/1/06 – 12/31/08

E-mail transmissions or other types of Powers of Attorney are not

Technical Assistance Advisement Request

dated 8/6/08

acceptable. Copies of Form DR-835 are readily available by visiting

Claim for Refund

3/7/07

our Internet site ( ).

Section 4 – To Appoint an Unemployment Tax Agent

How to Complete Form DR-835, Power of Attorney

Complete this section only if you wish to appoint an agent for

unemployment taxes on a continuing basis. You should not complete

PART I POWER OF ATTORNEY

Section 3 or Section 6, but you must complete the remaining sections

Section 1 – Taxpayer Information

of Form DR-835.

• For individuals and sole proprietorships: Enter your name,

address, social security number, and telephone number(s) in the

Enter the agent’s name. It must be the same name as found in

spaces provided. Enter your federal employer identification number

Section 2. Enter the firm name and address. You do not need to

(FEIN), if you have one. If a joint return is involved, and you and

complete the address line if you reported that information in Section 2.

your spouse are designating the same attorney(s)-in-fact, also enter

1.

Enter the agent number. The agent number is a seven-digit

your spouse’s name and social security number, and your spouse’s

number assigned by the Department of Revenue.

address if different from yours.

2.

Enter the federal employer identification number. The FEIN is a

• For a corporation, limited liability company, or partnership:

nine-digit number assigned to the agent by the Internal Revenue

Enter the name, business address, FEIN, a contact person familiar

Service.

with this matter, and telephone number(s).

3.

Select the mail type.

• For a trust: Enter the name, title, address, and telephone

Primary Mail. If you select primary mail, the agent will receive

number(s) of the fiduciary, and name and FEIN of the trust.

all documents from the Department of Revenue related to this

• For an estate: Enter the name, title, address, and telephone

unemployment tax account, and will be authorized to receive

number(s) of the decedent’s personal representative, and the name

confidential information and discuss matters related to the tax and

and identification number of the estate. The identification number

wage report, benefit information, claims, and the employer’s rate.

for an estate includes both the FEIN if the estate has one and the

Reporting Mail. If you select reporting mail, the agent will receive

decedent’s social security number.

the Employer’s Quarterly Report (Form UCT-6), certification, and

• For any other entity: Enter the name, business address, FEIN,

correspondence related to reporting. The agent will be authorized to

and telephone number(s), as well as the name of a contact person

receive confidential information and discuss the tax and wage report,

familiar with this matter.

certification, and correspondence with the Department.

• Identification Number: The Department may have assigned you

Rate Mail. If you select rate mail, the agent will receive tax rate

a Florida tax registration number such as a sales tax number, an

notices and correspondence related to the rate and will be authorized

unemployment tax account number, or a business partner number.

to receive confidential information and discuss the employer’s rate

These numbers further assist the Department in identifying your

notices and rate with the Department.

particular tax matter, and you should enter them in the appropriate

Claims Mail. If you select claims mail, the agent will receive the

box. If you do not provide this information, the Department may not

notice of benefits paid, and will be authorized to receive confidential

be able to process the Power of Attorney.

information and discuss matters related to benefits.

Note: Duplicate copies of certain computer-generated notices and

other written communications cannot be issued due to current system

constraints and therefore, these communications will be sent only to

the representative.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4