Power Of Attorney And Declaration Of Representative Page 4

ADVERTISEMENT

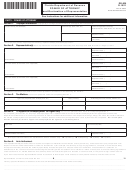

DR-835

R. 10/11

Page 4

Note: If you wish to appoint a representative to act on your behalf in

governing representation before the Department of Revenue. The

representative(s) must also declare, under penalties of perjury, that he

a specific and non-continuing unemployment tax matter, you should

complete Section 3 and Section 6 and not Section 4. For example,

or she has been authorized to represent the taxpayer(s) in this matter

if you hire a representative to assist you with a single matter, such as

and authorized by the taxpayer(s) to receive confidential taxpayer

an unemployment tax audit or contesting the payment of a claim, and

information.

wish that representative to handle just that one matter, you should

The representative(s) you name must sign and date this declaration

not complete Section 4 to authorize that representation. Instead, you

and enter the designation (i.e., items a-f) under which he or she is

should fill out Section 3 and specify the exact matter the representative

authorized to represent you before the Department of Revenue.

is handling.

a.

Attorney – Enter the two-letter abbreviation for the state (for

Section 5 – Acts Authorized

example “FL” for Florida) in which admitted to practice, along with

Your signature on the back of the Power of Attorney authorizes the

your bar number.

individual(s) you designate (your representative or “attorney-in-fact”)

b.

Certified Public Accountant – Enter the two-letter abbreviation

to perform any act you can perform with respect to your tax matters,

for the state (for example “FL” for Florida) in which licensed to

except that your representative may not sign certain returns for you

practice.

nor may your representative negotiate or cash your refund warrant.

This authority includes signing consents to a change in tax liability,

c.

Enrolled Agent – Enter the enrollment card number issued by the

consents to extend the time for assessing or collecting tax, closing

Internal Revenue Service.

agreements, and compromises. You may authorize your representative

d.

Former Department of Revenue Employee – Former employees

to receive, but not negotiate or cash, your refund warrant by checking

may not accept representation in matters in which they were

the box in Section 5 and writing the name of the representative on the

directly involved, and in certain cases, on any matter for a period

line below. If you wish to limit the authority of your representative other

of two years following termination of employment. If a former

than in the manner previously described, you must describe those

Department of Revenue employee is also an attorney or CPA,

limits on the lines provided in Section 5.

then the additional designation, jurisdiction, and enrollment card

Section 6 – Mailing of Notices and Communications

should also be entered.

If you do not check a box, the Department will send notices and other

e.

Unemployment Tax Agent – A person(s) appointed under

written communications to the first representative listed in Section 2,

Section 4 of the Power of Attorney to handle unemployment tax

unless you select another option. If you wish to have no documents

matters on a continuing basis. A separate Power of Attorney form

sent to your representative, or documents sent to both you and your

must be completed in order for an unemployment tax agent to

representative, you should check the appropriate box in Section 6.

handle a specific and non-continuing matter such as a protest of

Check the second box if you wish to have notices and other written

an unemployment tax rate.

communications sent to you and not to your representative. In

f.

Other Qualified Representative – An individual may represent

certain instances, the Department can only send documents to the

a taxpayer before the Department of Revenue if training and

taxpayer. Therefore, the taxpayer has the responsibility of keeping the

experience qualifies that person to handle a specific matter.

representative informed of tax matters.

Rule 28-106.107, Florida Administrative Code, sets out mandatory

Note: Taxpayers completing Section 4 (To Appoint an Unemployment

standards of conduct for all qualified representatives. A representative

Tax Agent Only) should not complete Section 6. See Section 4 of these

shall not:

instructions for information regarding notices and communications sent

to an unemployment tax agent.

(a)

Engage in conduct involving dishonesty, fraud, deceit, or

misrepresentation.

Section 7 – Retention/Nonrevocation of Prior Power(s) of Attorney

The most recent Power of Attorney will take precedence over, but will

(b) Engage in conduct that is prejudicial to the administration of

not revoke, prior Powers of Attorney. If you wish to revoke a prior

justice.

Power of Attorney, you must check the box on the form and attach a

(c)

Handle a matter that the representative knows or should know

copy of the old Power of Attorney.

that he or she is not competent to handle.

Section 8 – Signature of Taxpayer(s)

(d) Handle a legal or factual matter without adequate preparation.

The Power of Attorney is not valid until signed and dated by the

taxpayer. The individual signing the Power of Attorney is representing,

*Social security numbers (SSNs) are used by the Florida

under penalties of perjury, that he or she is the taxpayer or authorized

Department of Revenue as unique identifiers for the administration of

to execute the Power of Attorney on behalf of the taxpayer.

Florida’s taxes. SSNs obtained for tax administration purposes are

confidential under sections 213.053 and 119.071, Florida Statutes,

•

For a corporation, trust, estate, or any other entity: A corporate

and not subject to disclosure as public records. Collection of your

officer or person having authority to bind the entity must sign.

SSN is authorized under state and federal law. Visit our Internet

•

For partnerships: All partners must sign unless one partner is

site at and select “Privacy Notice” for

authorized to act in the name of the partnership.

more information regarding the state and federal law governing the

collection, use, or release of SSNs, including authorized exceptions.

•

For a sole proprietorship: The owner of the sole proprietorship

must sign.

Where to Mail Form DR-835

If Form DR-835 is for a specific matter, mail or fax it to the office or

•

For a joint return: Both husband and wife must sign if the

employee handling the specific matter. You may send it with the

representative represents both. If the representative only

document to which it relates.

represents one spouse, then only that spouse should sign.

PART II – DECLARATION OF REPRESENTATIVE

If Form DR-835 is for an unemployment tax matter and the taxpayer

Any party who appears before the Department of Revenue has the

has completed Section 4, mail it to the Florida Department of Revenue,

right, at his or her own expense, to be represented by counsel or by a

P.O. Box 6510, Tallahassee FL 32314-6510, or fax it to 850-488-5997.

qualified representative. The representative(s) you name must declare,

under penalties of perjury, that he or she is qualified to represent you in

this matter and will comply with the mandatory standards of conduct

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4