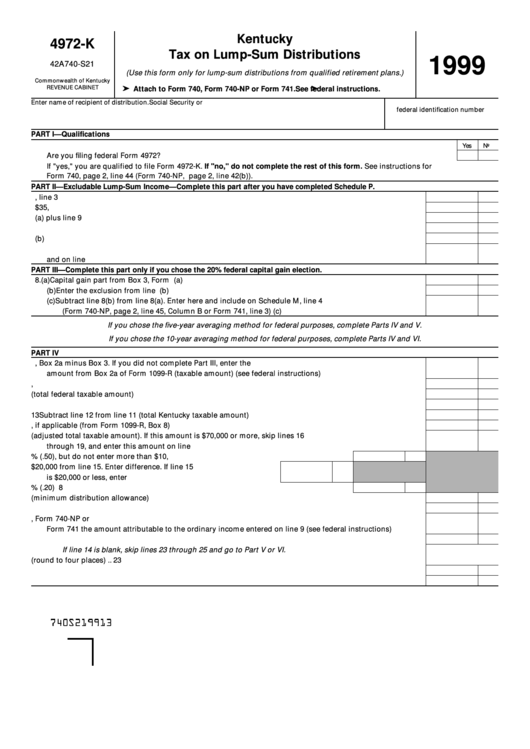

Kentucky Tax On Lump-Sum Distributions (Form 4972-K 1999)

ADVERTISEMENT

Kentucky

4972-K

Tax on Lump-Sum Distributions

1999

42A740-S21

(Use this form only for lump-sum distributions from qualified retirement plans.)

Commonwealth of Kentucky

ä

ä

REVENUE CABINET

Attach to Form 740, Form 740-NP or Form 741.

See federal instructions.

Enter name of recipient of distribution.

Social Security or

federal identification number

PART I—Qualifications

1. An individual who qualifies to file federal Form 4972 qualifies to file Form 4972-K.

Yes

No

Are you filing federal Form 4972? ..............................................................................................................................................

If "yes," you are qualified to file Form 4972-K. If "no," do not complete the rest of this form. See instructions for

Form 740, page 2, line 44 (Form 740-NP, page 2, line 42(b)).

PART II—Excludable Lump-Sum Income—Complete this part after you have completed Schedule P.

2. Enter the amount from Schedule P, line 3 ............................................................................................................. 2

3. Subtract line 2 from $35,700 ................................................................................................................................... 3

4. Enter the amount from line 8(a) plus line 9 ........................................................................................................... 4

5. Enter the lesser of line 3 or line 4 ........................................................................................................................... 5

6. Amount of line 5 to be applied to capital gain distributions. enter here and on line 8(b) ................................. 6

7. Amount of line 5 to be applied to regular lump-sum distributions. Subtract line 6 from line 5. Enter here

and on line 12 ........................................................................................................................................................... 7

PART III—Complete this part only if you chose the 20% federal capital gain election.

8. (a) Capital gain part from Box 3, Form 1099-R ................................................................................................ 8(a)

(b) Enter the exclusion from line 6 .................................................................................................................. 8(b)

(c) Subtract line 8(b) from line 8(a). Enter here and include on Schedule M, line 4

(Form 740-NP, page 2, line 45, Column B or Form 741, line 3) ................................................................ 8(c)

If you chose the five-year averaging method for federal purposes, complete Parts IV and V.

If you chose the 10-year averaging method for federal purposes, complete Parts IV and VI.

PART IV

9. Ordinary income from Form 1099-R, Box 2a minus Box 3. If you did not complete Part III, enter the

amount from Box 2a of Form 1099-R (taxable amount) (see federal instructions) ............................................ 9

10. Death benefit exclusion for a beneficiary of a plan participant who died before August 21, 1996 .................. 10

11. Subtract line 10 from line 9 (total federal taxable amount) ................................................................................. 11

12. Enter the exclusion from line 7 ............................................................................................................................... 12

13 Subtract line 12 from line 11 (total Kentucky taxable amount) ............................................................................ 13

14. Current actuarial value of annuity, if applicable (from Form 1099-R, Box 8) ..................................................... 14

15. Add lines 13 and 14 (adjusted total taxable amount). If this amount is $70,000 or more, skip lines 16

through 19, and enter this amount on line 20 ....................................................................................................... 15

16. Multiply line 15 by 50% (.50), but do not enter more than $10,000 ................................. 16

17. Subtract $20,000 from line 15. Enter difference. If line 15

is $20,000 or less, enter zero ........................................................... 17

18. Multiply line 17 by 20% (.20) .............................................................................................. 18

19. Subtract line 18 from line 16 (minimum distribution allowance) ........................................................................ 19

20. Subtract line 19 from line 15 ................................................................................................................................... 20

21. Federal estate tax attributable to lump-sum distribution. Do not deduct on Form 740, Form 740-NP or

Form 741 the amount attributable to the ordinary income entered on line 9 (see federal instructions) ......... 21

22. Subtract line 21 from line 20 ................................................................................................................................... 22

If line 14 is blank, skip lines 23 through 25 and go to Part V or VI.

23. Divide line 14 by line 15 and enter the result as a decimal (round to four places) ............................................ 23

24. Multiply line 19 by the decimal amount on line 23 ............................................................................................... 24

25. Subtract line 24 from line 14 ................................................................................................................................... 25

740S219913

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2