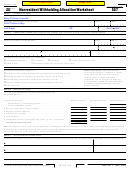

California 587 Form (2015) Nonresident Withholding Allocation Worksheet Page 2

ADVERTISEMENT

2015 Instructions for Form 587

Nonresident Withholding Allocation Worksheet

References in these instructions are to the California Revenue and Taxation Code (R&TC).

General Information

• The payee is a corporation, partnership,

Payments subject to withholding include

or limited liability company (LLC) that

the following:

Backup Withholding – With certain limited

has a permanent place of business in

• Payments for services performed in

exceptions, payers that are required to

California or is qualified to do business

California by nonresidents .

withhold and remit backup withholding

in California . Foreign corporations

• Payments made in connection with a

to the Internal Revenue Service (IRS)

must be qualified to transact intrastate

California performance .

are also required to withhold and remit

business . Use Form 590 .

• Rent paid to nonresidents if the rent is

to the Franchise Tax Board (FTB) on

• The payment is to an estate and the

paid in the course of the withholding

income sourced to California . The

decedent was a California resident . Use

agent’s business .

California backup withholding rate is 7%

Form 590 .

• Payments to nonresidents for royalties

of the payment . For California purposes,

Form 587 does not apply to payments for

from business activities sourced to

dividends, interests, and any financial

wages to employees . Wage withholding

California .

institution’s release of loan funds made in

is administered by the California

• Payments of prizes for contests

the normal course of business are exempt

Employment Development Department

entered in California .

from backup withholding . For additional

(EDD) . For more information, go to

• Distributions of California source

information on California backup

edd .ca .gov or call 888 .745 .3886 .

income to nonresident beneficiaries

withholding, go to ftb .ca .gov and search

from an estate or trust .

for backup withholding .

• Endorsement payments received for

B When to Complete

If a payee has backup withholding, the

services performed in California .

payee must contact the FTB to provide a

The withholding agent requests that the

• Other payments of California source

valid Taxpayer Identification Number (TIN)

nonresident payee completes, signs,

income made to nonresidents .

before filing a tax return . The following are

and returns Form 587 to the withholding

Payments not subject to withholding

acceptable TINs: social security number

agent when a contract is entered into

include payments:

(SSN); individual taxpayer identification

and before a payment is made to the

number (ITIN); federal employer

• To a resident of California or to a

payee . The withholding agent relies on

identification number (FEIN); California

corporation, LLC, or partnership, with

the certification made by the payee to

corporation number (CA Corp no .); or

a permanent place of business in

determine the amount of withholding

California Secretary of State (CA SOS)

California .

required, provided the completed and

file number . Failure to provide a valid

• To a corporation qualified to do

signed Form 587 is accepted in good faith .

TIN will result in the denial of the backup

business in California .

Form 587 remains valid for the duration

withholding credit .

• For sale of goods .

of the contract (or term of payments),

• For income from intangible personal

provided there is no material change in

A Purpose

property, such as interest and

the facts . By signing Form 587, the payee

dividends, unless the property has

agrees to promptly notify the withholding

Use Form 587, Nonresident Withholding

acquired a business situs in California .

agent of any changes in the facts .

Allocation Worksheet, to determine if

• For services performed outside

withholding is required, and the amount

The withholding agent retains Form 587

of California .

of California source income subject to

for a minimum of four years and must

• To a payee that is a tax-exempt

withholding .

provide it to the FTB upon request .

organization under either California or

Withholding is not required if payees are

federal law . Use Form 590 .

C Income Subject to

residents or have a permanent place of

• To a payee that is a government entity .

business in California . Get FTB Pub . 1017,

Withholding

• To reimburse a payee for expenses

Resident and Nonresident Withholding

relating to services performed in

California Revenue and Taxation Code

Guidelines, for more information .

California if the reimbursement is

(R&TC) Section 18662 and the related

separately accounted for and not

Do not use Form 587 if any of the

regulations require withholding of income

subject to federal Form 1099 reporting .

following apply:

or franchise tax on certain payments made

Corporate payees, for purposes

• You sold California real estate .

to nonresidents (including individuals,

of this exception, are treated as

Use Form 593-C, Real Estate

corporations, partnerships, LLCs, estates,

individual persons .

Withholding Certificate .

and trusts) for income received from

• The payee is a resident of California

California sources .

D Waivers/Reductions

or is a non-grantor trust that has

Withholding is required if total payments

at least one California resident

A nonresident payee may request that

of California source income to the

trustee . Use Form 590, Withholding

withholding be waived . To apply for

nonresident payee during the calendar

Exemption Certificate .

a withholding waiver, use Form 588,

year exceed $1,500 . The withholding rate

Nonresident Withholding Waiver Request .

is 7% unless the FTB grants a waiver .

A nonresident taxpayer has the option

See General Information D, Waivers/

to request a reduction in the amount to

Reductions .

be withheld . To apply for a withholding

Form 587 Instructions 2014 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3