Combined Form W-4 And Mw 507 2005

Download a blank fillable Combined Form W-4 And Mw 507 2005 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Combined Form W-4 And Mw 507 2005 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

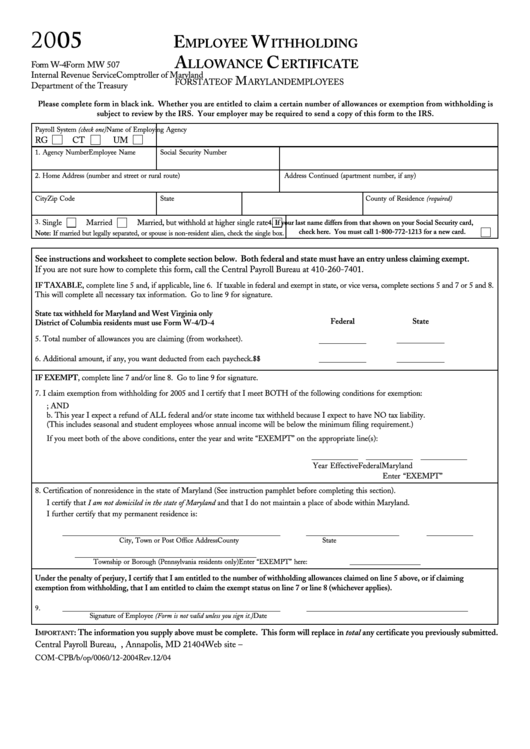

2005

E

W

MPLOYEE

ITHHOLDING

A

C

LLOWANCE

ERTIFICATE

Form W-4

Form MW 507

Internal Revenue Service

Comptroller of Maryland

M

FOR STATE OF

ARYLAND EMPLOYEES

Department of the Treasury

Please complete form in black ink. Whether you are entitled to claim a certain number of allowances or exemption from withholding is

subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS.

Payroll System (check one)

Name of Employing Agency

RG

CT

UM

1. Agency Number

Social Security Number

Employee Name

2. Home Address (number and street or rural route)

Address Continued (apartment number, if any)

City

State

Zip Code

County of Residence (required)

3.

Single

Married

Married, but withhold at higher single rate

4. If your last name differs from that shown on your Social Security card,

check here. You must call 1-800-772-1213 for a new card.

Note: If married but legally separated, or spouse is non-resident alien, check the single box.

See instructions and worksheet to complete section below. Both federal and state must have an entry unless claiming exempt.

If you are not sure how to complete this form, call the Central Payroll Bureau at 410-260-7401.

IF TAXABLE, complete line 5 and, if applicable, line 6. If taxable in federal and exempt in state, or vice versa, complete sections 5 and 7 or 5 and 8.

This will complete all necessary tax information. Go to line 9 for signature.

State tax withheld for Maryland and West Virginia only

Federal

State

District of Columbia residents must use Form W-4/D-4

5. Total number of allowances you are claiming (from worksheet).

6. Additional amount, if any, you want deducted from each paycheck.

$

$

IF EXEMPT, complete line 7 and/or line 8. Go to line 9 for signature.

7. I claim exemption from withholding for 2005 and I certify that I meet BOTH of the following conditions for exemption:

a. Last year I had a right to a refund of ALL federal and/or state income tax withheld because I had NO tax liability; AND

b. This year I expect a refund of ALL federal and/or state income tax withheld because I expect to have NO tax liability.

(This includes seasonal and student employees whose annual income will be below the minimum filing requirement.)

If you meet both of the above conditions, enter the year and write “EXEMPT” on the appropriate line(s):

Year Effective

Federal

Maryland

Enter “EXEMPT”

8. Certification of nonresidence in the state of Maryland (See instruction pamphlet before completing this section).

I certify that I am not domiciled in the state of Maryland and that I do not maintain a place of abode within Maryland.

I further certify that my permanent residence is:

City, Town or Post Office Address

County

State

Township or Borough (Pennsylvania residents only)

Enter “EXEMPT” here:

Under the penalty of perjury, I certify that I am entitled to the number of withholding allowances claimed on line 5 above, or if claiming

exemption from withholding, that I am entitled to claim the exempt status on line 7 or line 8 (whichever applies).

9.

Signature of Employee (Form is not valid unless you sign it.)

Date

I

: The information you supply above must be complete. This form will replace in total any certificate you previously submitted.

MPORTANT

Central Payroll Bureau, P.O. Box 2396, Annapolis, MD 21404

Web site –

COM-CPB/b/op/0060/12-2004Rev.12/04

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1